350 PPM blog

Turning climate tech ideas into global commercial success

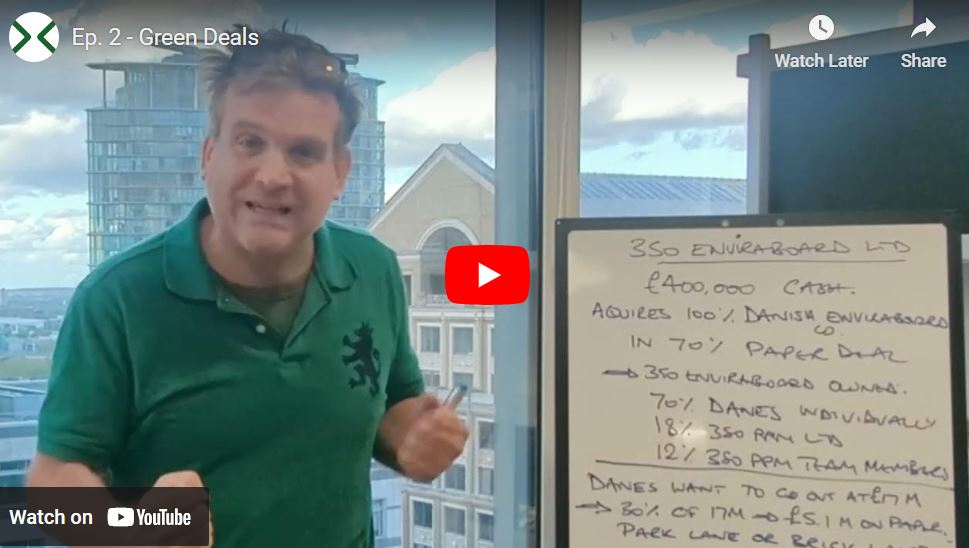

Ep.2 – Green Deals

Today’s video is a how it works, behind the scenes look at what we do at 350 PPM. Y…

Read MoreBuilding a sustainable future

By Nick Dimmock, CEO and Founder at 350 PPM As the developed world moves towards net zero targets, i…

Read MoreEp.1 – Green Deals

As a moderately sane Gen X’er I have started watching a lot of YouTube. The news is still quit…

Read More350 PPM Looks to Scale Business Model

350 PPM LTD is funding. We funded in 2016, raising circa £100,000 to get the business going, in 2019…

Read More350 PPM launches fundraise campaign for green tech expansion

We have launched a campaign to raise funds for the expansion of our business – specifically ta…

Read MoreUnearthing investment for the green economy

The green economy refers to an economic system that aims to foster sustainability and reduce environ…

Read MoreENG8 Accepts Investment Fund Offer, GreenMine Scales, 350 PPM Preps for JP Jenkins Listing

Dear All, Here are the updates for this month: ENG8 International Ltd ENG8 has accepted the offer fr…

Read MoreGreenMine secures tech validation for UK landfill solution

Working with the multi-disciplinary engineering consultancy, Stopford, the UK-based waste carbonisat…

Read MoreGreenMine Attracts Institutional Interest, ENG8 20M Term Sheet Imminent, 350 PPM Stakes Objectives

Dear All, We haven’t provided an update for 3 weeks, so please find below the following: GreenMine G…

Read MoreGreenMine secures advance assurance for Enterprise Investment Scheme

We’re pleased to report that GreenMine has been awarded advanced assurance for the Enterprise Invest…

Read MoreGreenMine begins its run of the entrepreneurial gauntlet to Institutional Investment

Dear All, Did you know that Running the Gauntlet has no relation to the glove? The term “Running The…

Read MoreGreenMine secures first waste carbonisation site in Wales

UK-based waste carbonisation business, GreenMine, has secured its first operational site – an indust…

Read MoreLandfill stinks

By Nick Dimmock, Director of Investor Relations at 350PPM And we’re not just talking about the smell…

Read More350 PPM LTD: Highlights of 2023 – PART 5

Please see below for Part 5 of our 2023 highlights series though GreenMine is really our focus for 2…

Read MoreENG8 at Greenbackers COP28 (Pitch) in London

GREENBACKERS Investment Capital are specialists for cleantech and climate technology venture ca…

Read More350 PPM LTD: Highlights of 2023 – PART 4

Please see below for Part 4 of our 2023 highlights series. ENG8 now completing due diligence with t…

Read More350 PPM LTD: Highlights of 2023 – PART 3

Please see below for Part 3 of our 2023 highlights series. Megawatt Mosaic Records 1st Year Revenue…

Read More350 PPM LTD: Highlights of 2023 – PART 2

Please see below for Part 2 of our 2023 highlights series. Organic Heat Exchangers Ltd is the inven…

Read More350 PPM LTD: Highlights of 2023 – PART 1

Overall, if you take the value of the four companies we were working with on 1st January 2023, which…

Read MoreTime to turn the tide on climate change

By Dr Jacqui Taylor, Clean Tech Advisor at 350PPM COP28 marked a pivotal moment in climate change ta…

Read MoreWhat’s the big deal about the earth getting hotter?

As we eagerly await the outcome of COP28 later this week, many will be taking stock of the targets s…

Read MoreGreenMine is the new trading name for Pyrolysise

GreenMine, the new trading name of Pyrolysise Ltd, is gaining significant traction. GreenMine has co…

Read MoreNew grant funding adviser joins the team

We’re excited to announce that Colm Macqueen has joined the team at 350PPM. As a keen supporter of i…

Read MoreNew expert clean tech advisor

We’re delighted to welcome Dr Jacqui Taylor to our team. Jacqui is a high-level climate leader recog…

Read MoreArchives

Search by category

- 350 PPM (5)

- Clients (1)

- Directors Comment (15)

- Environmental issues (2)

- Green Deals Videos (2)

- News (217)

- Research (24)

- Uncategorized (21)

- Updates (69)

- Video News (13)

Search by date

- April 2024 (4)

- March 2024 (4)

- February 2024 (4)

- January 2024 (7)

- December 2023 (2)

- November 2023 (9)

- October 2023 (9)

- September 2023 (5)

- August 2023 (7)

- July 2023 (4)

- June 2023 (2)

- May 2023 (5)

- April 2023 (5)

- February 2023 (3)

- January 2023 (4)

- December 2022 (1)

- November 2022 (5)

- October 2022 (9)

- September 2022 (7)

- August 2022 (5)

- July 2022 (1)

- June 2022 (1)

- May 2022 (2)

- April 2022 (1)

- March 2022 (7)

- February 2022 (2)

- January 2022 (4)

- December 2021 (2)

- November 2021 (8)

- October 2021 (5)

- September 2021 (7)

- August 2021 (6)

- July 2021 (2)

- June 2021 (1)

- May 2021 (2)

- April 2021 (2)

- March 2021 (1)

- February 2021 (1)

- January 2021 (2)

- December 2020 (1)

- November 2020 (2)

- October 2020 (2)

- July 2020 (4)

- June 2020 (5)

- May 2020 (2)

- April 2020 (1)

- March 2020 (3)

- February 2020 (2)

- January 2020 (5)

- December 2019 (2)

- November 2019 (1)

- September 2019 (2)

- August 2019 (1)

- July 2019 (2)

- June 2019 (2)

- May 2019 (2)

- April 2019 (1)

- March 2019 (1)

- February 2019 (3)

- January 2019 (2)

- December 2018 (2)

- November 2018 (1)

- October 2018 (1)

- August 2018 (1)

- April 2018 (2)

- March 2018 (2)

- February 2018 (3)

- January 2018 (1)

- November 2017 (1)

- October 2017 (5)

- January 2017 (2)

- December 2016 (2)

- September 2016 (1)

- April 2016 (5)

- March 2016 (2)

- February 2016 (8)

- January 2016 (3)

- December 2015 (2)

- November 2015 (2)

- October 2015 (3)

- September 2015 (2)

- August 2015 (2)

- July 2015 (3)

- June 2015 (2)

- May 2015 (4)

- April 2015 (4)

- March 2015 (6)

- January 2015 (5)