Author: Nicholas Dimmock BA MBA(CASS), Head of Corporate Finance 350 PPM Ltd.

About 350 PPM

350 PPM Ltd is a corporate finance house, specialising in EIS qualifying, socially responsible / green investments within the environmental sector.

350 PPM Ltd identifies Companies, Projects and Technologies that it believes will benefit substantially from the implementation of The Paris Agreement; the new global treaty to combat climate change and the environmental revolution, which is now fully underway.

350 PPM then structures these opportunities under the UK’s Enterprise Investment Scheme (EIS) and works with, advises and raises finance for the above businesses along the commercialisation runway, to ensure they reach their full potential.

The commercialisation runway is defined within 350 as 4 financing stages: Incubation (typically via EIS), Expansion (via EIS), Venture Capital (Pre-IPO via VC’s, Family Offices, Institutional Investors etc), and Listing via 350’s NOMAD Partners.

350 PPM always invests in the companies it champions alongside it’s investment clients. By working closely with the company at every stage and assisting in its growth where possible, 350 PPM can protect its and its investor’s interests, influence the outcomes and share in the company’s and its clients success both now and in the future.

Investors can register for further information here: https://350ppm.co.uk/enterprise-investment-scheme/ or via our Electronic Funding Platform here: https://350ppm.envestry.com/.

Businesses, Projects and Technologies looking for funding can register here: https://350ppm.envestry.com/companies/new

_____________________________________________

Table of Contents

The Conference of The Parties 23 (COP23)

From an Investors’ Perspective

_____________________________________________

Executive Summary

Client Company News:

More client company news is detailed below in the appropriate section. You can skip there in advance by clicking on any of the links in the Index above but in short:

Solar 350 Ltd: Solar 350 has been in combat with HMRC’s Small Company Enterprise Centre in regard to our continued qualification under the Enterprise Investment Scheme. Full transcripts are available below. However, due to time constraints, we have decided to sell our first two projects in whole or in part and are marketing these to the industry now. As of 14th February, it would appear that a consortium of employees working for a major European Investment Bank, will be investing circa $2,000,000 in a carve out from Solar 350, in order to finance the development of these projects to shovel ready / ready to build with Solar 350 retaining 45% of the upside and our partners in Mexico (developers/landowners) retaining 10%. The agreement on our second set of sites in Mexico is complete and we are due to start development of these sites (a further 300MW) shortly.

Disarmco Holdings Ltd: Their confidential update report was recently sent out to investors.

Storelectric Ltd: A consortium of employees working within the Infrastructure Division of a major US Investment Bank in London have now completed their investment in TES CAES Technology Limited (‘TCTL’), which is the carve out from Storelectric Ltd. This group are also now preparing to finance the development of Storelectric’s first project. The commitments as detailed above equate to investment within the business and associated companies of circa £2,000,000. PPM’s investors have received their duplicate shareholding in TES. In addition, Storelectric is now selecting 10 project sites from around the United Kingdom.

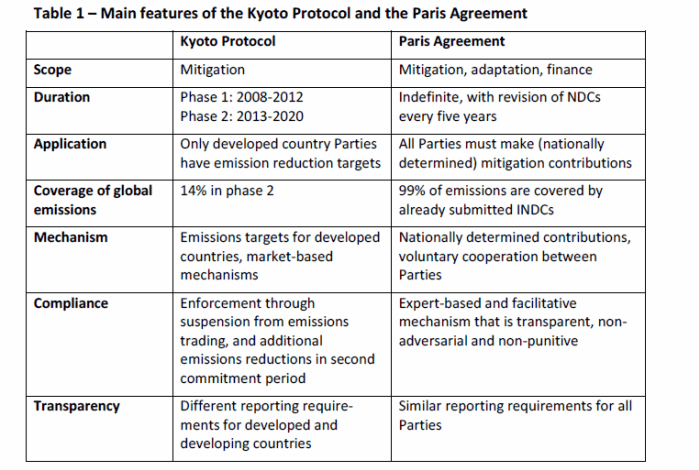

350 PPM has agreed to sponsor a Conservative Party Fundraising event on March 20th in Pall Mall (invites can be extended to our investor clients should you wish to attend). We are also moving office and are just selecting our office, but most likely this is going to be No 1 Mayfair Place, Green Park, London. 350 PPM is also searching for other Project Developers with experience and ambition within the sector, that we can incubate and develop in the same manner as detailed above. Under The Kyoto Protocol, there were roughly 15,000 new environmental projects globally between 2007 and 2012. With The Paris Agreement, we expect 100,000 new projects to 2050. 350 PPM has made 4 additional hires of late and is gearing up to expand its marketing and sales efforts in line with positive developments within the sector and The Paris Agreement.

Industry News:

The annual round of The United Nations Climate talks were held in Bonn, Germany in December 2017.

It was due to be held in Fiji, but due to a typhoon, the logistics of hosting a 27,000-person convention in The South Pacific and the cost involved, Germany stepped in.

The purpose of the COPs now, and the interim meetings held during the year is to work out the finer details, mechanisms, rules and monitoring processes of The Paris Agreement, as we move towards its implementation on 1st January 2020, plus pre-2020 commitments to Climate Finance.

Syria confirmed that would sign The Paris Agreement (many now claim that the original unrest in Syria stemmed from failing crops due to climate change), meaning that only the United States is non-committal.

However, two US Delegations attended: the official one, and a further unofficial “We are Still In” Delegation headed by New York Major Michael Bloomberg and promoting their “America’s Pledge” Report which details the commitments of businesses, cities and states for emission reductions across the US.

You can read more about developments at COP 23 here: https://www.carbonbrief.org/cop23-key-outcomes-agreed-un-climate-talks-bonn, but in short, the objective is still to keep average global temperatures within a two degree limit of pre-industrial times, there is going to be a mechanism to ratchet up ambitions above the NDCs (reductions pledges) already submitted by individual countries and there was standard moaning in relation to: no provisions agreed for loss or damage as a result of climate change, the developed world still hasn’t made good its commitment to provide 100 Billion USD of climate finance per year and the Doha Amendment, which is the second commitment period of The Kyoto Protocol leading up to 2020, has still not been ratified by enough countries to bring it into force.

A nice summary of The Paris Agreement versus The Kyoto Protocol is detailed here:

In short, its miles ahead of the Kyoto Protocol in ambition.

_____________________________________________

350’s Take on Events

You can view individual countries NDC’s (Nationally Determined Contributions or emission reduction pledges) here: http://www4.unfccc.int/ndcregistry/Pages/All.aspx

These NDC’s must be renewed every 5 years. What you may notice is that the base year – the snapshot of emissions from which all the reduction targets are pegged to, has already happened.

Jordan’s base year is 2006, targeting a 12.5% reduction by 2030 (http://www4.unfccc.int/ndcregistry/PublishedDocuments/Jordan%20First/Jordan%20INDCs%20Final.pdf).

Mexico’s is 25% from 2013 to 2030 (http://www4.unfccc.int/ndcregistry/PublishedDocuments/Mexico%20First/MEXICO%20INDC%2003.30.2015.pdf.

Malaysia’s is 35% in terms of carbon intensity with base year of 2005 and by 2030.

Some countries divide their reduction commitments into unconditional and conditional based on the availability of international finance, hence why many are pursing the developing world for their promises of support

Regardless, of that fact that these all need to be tightened up, our main point is that if your base year of emissions, from which your reduction schedule is calculated has already happened, then the race to reduce your emissions is on already, regardless of the fact that The Paris Agreement doesn’t officially start until 1st January 2020.

This has been 350’s experience from speaking to other project developers in other countries. We may not be that cognizant of these developments in the UK, as the UK has other issues its dealing with, with a matter of urgency (BREXIT, but other countries are gearing up to ensure they hit and exceed their targets.

The second major issue is that Article 6 of The Paris Agreement, which details International Trade in Emission Reductions through fungible ITMO (Intended Mitigation Outcomes), is still current and the UN is currently re-gearing its accreditation processes to validate emission reductions and again act as central counterparty in environmental projects around the world. We know this because one of Solar 350 consultants has just been hired by the UNFCCC to fulfil a similar role.

It was this trade in emission reductions that really supercharged The Kyoto Protocol, and lead to circa 12,000 environmental projects between 2000 and 2012, which from an emissions reductions perspective dwarfed the efforts of the developed world mandatory reduction schedules under their emissions trading schemes.

How these emission reductions will be traded between countries has not yet been defined and the degree to the individual countries extend the ITMO’s to their domestic markets or chose to use carbon units or other intensives / subsidies is currently being decided.

It would appear however that carbon trading is back on the menu as the most effective way of monitoring and reducing emissions (http://documents.worldbank.org/curated/en/468881509601753549/pdf/120810-WP-PUBLIC-wb-report-171027.pdf

_____________________________________________

Activity Steps Up Again:

Last year, we saw a significant upswing in the environmental sector as detailed by REN21’s Renewables Global Status Report which can be downloaded here:

http://www.ren21.net/gsr-2017/

and REN21’s Renewables Global Futures Report 2017, which can be downloaded here:

https://www.ren21.net/2017-renewables-global-futures-report/.

Of course, REN’s focus is of course solely renewable energy. According The International Energy Agency (IEA: http://www.iea.org/Textbase/npsum/ETP2012SUM.pdf), 46 trillion USD will flow into this area of the environmental revolution between now and 2050.

This leaves $32 trillion of the estimated $78 trillion needed to be invested in Carbon Abatement (measures to reduce carbon pollution non-energy related, Energy Efficiency (measures to produce more with less or to save energy and Adaptation (measures taken to co-exist with the effects of climate change – flood defences, guarantees for insurers, mitigation efforts etc.

This is if you believe Lord Stern’s original estimate of the required investment to combat the most serious effects of climate change, namely 2% of global GDP or “2 Trillion USD per year”.

Nicholas Stern was the Chief Economist at The World Bank and a thought leader on the economics of the subject. You can read more about him here, but he is in short, as Ex Chief Economist of The World, the father of the environmental revolution:

https://en.wikipedia.org/wiki/Nicholas_Stern,_Baron_Stern_of_Brentford.

At 350, we tend to conceptualise the opportunities presented by The Paris Agreement in term of the 4 Musketeers of The Environmental Revolution:

- Carbon Abatement – reducing CO2e emissions in absolute terms such as though plugging old oil wells and gas pipelines, reducing industrial emissions through various scrubbers and converters, or through fuel switch projects (coal to gas, petrol to electric).

- Renewable Energy – generating additional energy required through renewable means

- Energy Efficiency – utilising energy more efficiently through voltage optimisers, smart grids, energy storage, insolation, building design etc

- Mitigation and Adaptation – dealing with the problems caused by climate change – thus flood defences, emergency housing and sanitation, immigration control, security.

_____________________________________________

From an Investors’ Perspective

Investors investing in the sector should not really consider themselves pioneers. The pioneers already have the arrows in their back from the demise of The Kyoto Protocol.

If Lord Stern is to be believed, The Paris Agreement will set off 2 trillion USD per year of investment and spending and thus preparing for this tsunami of funding and finding the solutions that will solve the problems should provide the richest seams. Please note, this is not market size, which is the sum of all transactions completed in the sector. This is new cash into the sector.

350 PPM’s client focus will increasingly be Project Developers that can roll out 10-100 projects across similar methodologies and specialisations over the next 10 years.

If they are supported by appropriate Technology IP, this can either be a benefit or a distraction as experience has shown us that rather than seeking the silver bullet it is better to just get on with the projects using existing established technologies, which are already approved by banks for debt financing.

Another advantage of project-based work versus the pursuit of technological innovation or trying to sell a product, is that the assets created during the project development cycle have a firm and inherent value as they are developed and accredited, which means each milestone in the 20-step accreditation, development and construction process adds value to the company and can be enjoyed by the investor as the project develops on a month by month basis.

In other words, it not about inspiration, it’s just about grinding it out and achieving the milestones one by one.

Now onto the Company Updates…

_____________________________________________

Carbon 350 Ltd

Carbon 350 has been involved in accreditation, development and brokerage of emission reductions from circa 40 environmental projects since 2008

Peak revenue reached £1.25M in 2011, but since the fall in the prices of emission assets in 2012, there has been little activity. Overall, there are circa 10.5 Million emission reductions which according to our agreements with our clients, Carbon 350 will net 10% of the on-sale value of the assets. When the Certified Emission Reductions were priced at €12, this revenue was very significant. Currently, CERs are priced a €0.22, although there are provisions for these assets to be utilised with The Paris Agreement and as such an upswing in price is possible as The Paris Agreement gets truly underway.

However, at €0.22, no one is issuing as the costs of issuance do not warrant to potential revenues. However, Carbon 350 should receive revenues from 2 Chinese Certified Emission Reduction (CCER) Projects (these are projects developed for the Chinese Emission Trading Scheme) which should be issuing soon and Carbon 350 may have an increasing role to play as The Paris Agreement is implemented.

_____________________________________________

Solar 350 Ltd

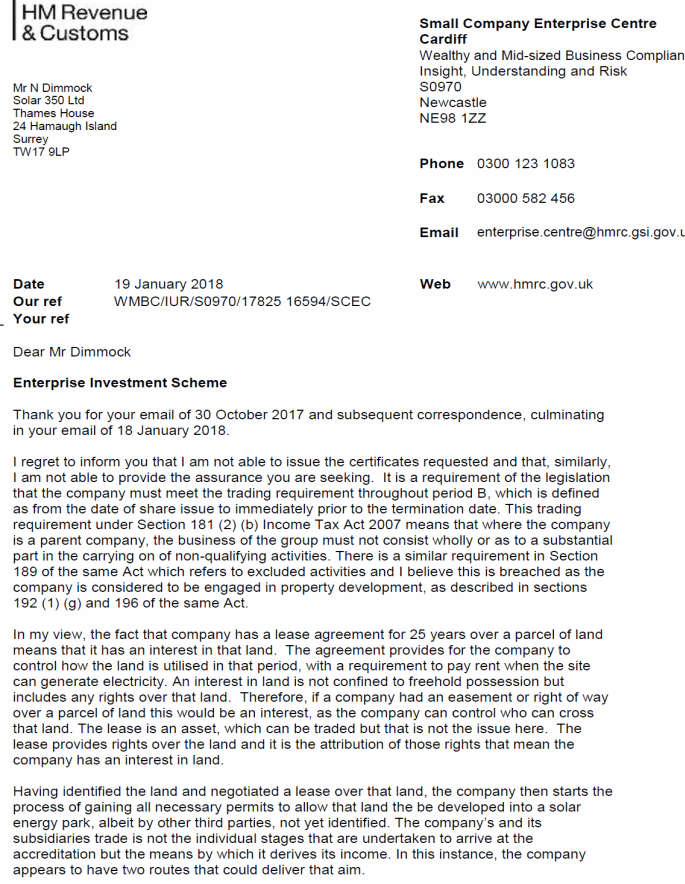

Solar 350 has been locked in mortal combat with SCEC (Small Companies Enterprise Centre – a division of HMRC that reviews and clears EIS claims.

The urgency and intensity of this battle has increased in order that Solar 350 can provide its clients with EIS3 forms to claim their tax returns on their annual filings due by 31st January.

The issue is whether Solar 350 is a Property Developer, which is an excluded activity. I know you may now be thinking that this is as absurd as we do, so here is their logic:

“Solar 350’s subsidiary holds a 25-year lease which becomes active once the project is operational. This constitutes an “interest in land”.

An interest in land means that you are a Property Developer and the interest in land accounts for more than 20% of your revenues, which means that it is a significant part of your business (revenues define your trade).

Property Development is an excluded activity, which means you don’t qualify for EIS.”

Our response is:

Our lease agreement is not an interest in land. It cannot be sold on, or novated or monetised and as such is not an interest in land. It is a liability.

Even if it was an “interest”, the land lease only accounts for 1 step of the 20 development steps required for a project to reach ready to build status, or 1 in 30 steps to reach operational.

We have now hired a legal firm to either get Queens Council approval on whether it is an interest, adapt the lease agreement to ensure the lease is not seen as an interest or suggest another structure.

Our most recent correspondence with SCEC and our response is detailed on the following pages.

Moving Forward

Everyone is confident that we will ultimately gain the EIS Status, however as this can’t be guaranteed, we have decided to put our subsidiaries and projects up for sale in whole or preferably part and will be running a reserve auction from 14th through to the 28th of February.

For the first two projects (90&160MW), we are asking for $2,000,000 for 45% of the company holding the development assets and we will complete the rest of the work. Based on 2M there is an exit for the buyer at Ready to Build, worst case at $11,250,000 or at COD, worst case at $18,111,518

HMRC / SCEC Letter

Solar 350 Response

Dear XXXX,

I forwarded your letter to my co-workers after I received it with the wording:

“No idea what he is talking about” on the header.

Now I have read it again, I am very confident that you have no idea what you are talking about in relation to the proposed operations of Solar 350 Ltd.

You have shot from the hip, without fully understanding our business. You have interpreted emails incorrectly and utilised these facts to make your decisions and after two years in limbo you have failed to pick up the telephone and discuss your opinions before issuing your judgement.

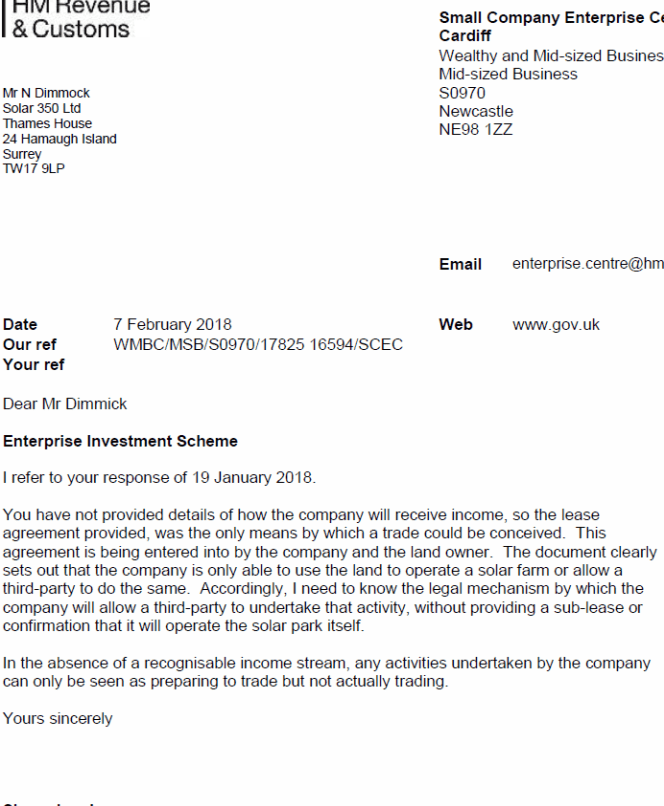

Your proposed first option of monetisation is just quite comical – where this came from I have no idea. Your proposed 2nd option of monetisation, just doesn’t exist as we are not allowed to novate (sell on) the lease agreement nor have we ever mentioned that we would sell it on.

You also seem to fail to take account of the fact that the land lease is a very small part (non-substantial) part of our trade or activities and your interpretation of the rules seem out of synch with governments guidance found here: https://www.gov.uk/hmrc-internal-manuals/venture-capital-schemes-manual/vcm3010

If you could come back to me with a legitimate reason, based on the rules and based on our proposed business, why we do not qualify perhaps I can move on from this ground hog day experience.

Regardless, if your reasoning is correct, and this is a big if, this would allow HMRC to overturn every single UK EIS Solar Farm, based on the fact that they are involved in “property development” – this would get you back a minimum 300 Million in income tax, plus lots of CGT would become due – can I ask if you are doing this – or there are other rules for larger companies?????

I have no idea what your final line means either: I look forward to receiving your agreement the compliance statement for shares issued on 14th November 2016.

This is like a mediaeval court. No opportunities to discuss or reason, no guidance or assistance, just an authoritarian no, based on incorrect interpretations.

Yours Sincerely,

Nick Dimmock

Managing Director

Solar 350 Ltd

HMRC / Small Company Enterprise Response

We are currently drafting our response to the above and have a few other manoeuvres reserved for the SCEC. I can confirm that our EIS Consultant, Boyd Carson of Sapphire Capital believes very very strongly that our business is EIS Qualifying and we will get clearance very soon.

_____________________________________________

350 PPM LTD 2.0

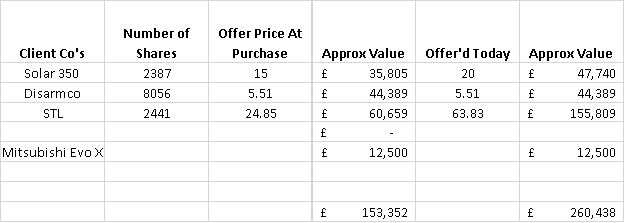

350 PPM Ltd gained the following shareholding in companies we promoted in 2017 as follows:

This is actually a list of assets on the 350 PPM balance sheet hence the Mitsubishi EVO X.

Accordingly, in the calendar year 2017, 350 PPM made profits of circa £140,000, on which corporation tax is theoretically due if we finish our financial year in the same position.

There is very little point in recording a profit if the objective is to go for growth an accordingly, PPM is open to new investment.

Please contact nickd@350ppm.co.uk, your SIRC (Senior Investor Relations Consultant) or your Climate Angel if you are interested in looking at this.

I appreciate a lot of investors are hunting dividends and thus need profits to facilitate this, but if you are involved in a rapidly expanding market, it is much better to go for growth rather than paying out dividends.

Everybody is valuing businesses with discounted cash flow models and funding via equity for growth stocks in nascent markets and as such to start paying corporation tax when capital gains for investors are tax free under the EIS, makes little sense.

Plus, we are hiring, and I need to boost our digital marketing which is now in place and working.

Digital Marketing

We are now live and promoting ourselves on:

Google AdWords: https://350ppm.co.uk/enterprise-investment-scheme/

Facebook: https://www.facebook.com/350ppm.co.uk/

LinkedIn: https://www.linkedin.com/company/350-ppm-ltd/

Both Facebook and linked in are also running animated advertisements along the same lines as google AdWords.

While digital marketing hasn’t worked for us before on a spend of circa 3k in December we attracted 100 new enquiries.

Climate Angels

We have now hired our first Climate Angel and plan more hires going forward.

Unlike our Senior Investor Relations Consultants, our climate angels perform a more passive role assisting potential clients with utilising the technology as well as servicing the potential client’s requirements for information.

The logic behind this, is as follows: although Crowdfunding has taken off (following the crowd is still an absurd concept in investing in my opinion), many investors require and prefer some sort of client facing experience. As our investor numbers have grown it has become increasingly difficult to service the requirements of all investors and accordingly the climate angels can fulfil both these objectives.

_____________________________________________

Disarmco Holdings Ltd

A confidential update has recently been sent to Disarmco investors. If you have not received this, please contact us.

_____________________________________________

Storelectric Ltd

UPDATE Feb 2018

2017 was a memorable year for Storelectric punctuated with important (positive) developments in the energy market increasing emphasis and realisation for the need for large scale storage. There were also important milestones and successes achieved by Storelectric and 2018 is now expected to be our showcase year.

So what do we expect in 2018, well the following: a successful completion of the Pre FEED, the completion of the FEED and the completion of full planning approval for a 1st TES CAES project in Cheshire; completed technical validation for both the TES and CCGT CAES technologies; the setting up of several new project vehicles across the UK.

It is the following achievements in 2017 that have made these targets real and tangible,

- Secured funding for TES CAES technology validation & roll out

- Secured funding for Storelectric Ltd operations and continued technology and business development

- Appointment of a Chairman for a 3year contract having extensive experience in the financing of infrastructure projects and related contact network (an ex Partner of PwC).

- Renegotiated agreements with key market players to support Storelectric’s growth (such as with PwC), revitalised important existing relationships (such as with Fortum) and covered agreed over accruals to key partners (such as Dentons). We are safeguarding and protecting our expert network.

- Appointment of 350ppm as our finance broker to support Storelectric’s financing requirements and development aspirations.

Following on from our previous update we have completed the extended habitat survey on the Cheshire site & have now started up the pre-feed work including release of purchase orders amounting to ~ £50’000.

- Costain are close to completing the initial sanity check on our existing base system design. Results are promising.

- Costain have been introduced to Fortum (our contractor for the Dynamic Pant Simulations) and the base case is now being modelled by Fortum.

- 1st review of simulations have shown good results and we expect to make a detailed review at Fortum’s Helsinki site on 9th Feb 2018

- We expect the final report from Fortum middle Feb 2018

- We expect the final presentation of the pre feed by Costain to investors and to our management team by the end of February 2018 with the final Pre Feed report released end Feb.

- So far the Pre Feed is on schedule. This is an important milestone to allow start up the FEED phase.

As mentioned in our last update we are keen to secure several collaboration agreements with key engineering and environmental companies active in our energy space. These collaborators represent key stakeholders in our project screening process helping to identify the most optimum locations to take to the next phase of development. I am happy to announce that we have agreed in principle 2 of the 3 and are now in the final stages of finalising these agreements. The 3rd is under development and we hope to announce further news at our next update.

As our project pipeline is an important part of our activities for 2018 we are in the process of revamping and upgrading our website, again we are very pleased to announce that this is almost complete and should be online by March 2018.

On the promotions side Storelectric Ltd has been selected as one of only several companies to present at Cleantech 2018, this is scheduled for March and we expect it to generate further interest in our technology. Further updates will be provided at the next update. We are continuing to strengthen our relationship with the regulators, political establishment and institutions with a presentation to Baroness Featherstone and to various select committees in Feb/March 2018. It is important for Storelectric to continue making the case for grid scale storage and though an arduous process we believe our patience is beginning to pay off as this message is slowly but surely being listened to.

_____________________________________________

Pricing

Current pricing is…

Solar 350: £20

Disarmco: £5.51

Storelectric: £63.83

_____________________________________________

Contact Information

Tel: 0203 151 1 350 (Switch Board)

Tel: 0203 151 2 350 (Direct)

Fax: 0203 151 9 350

New Corporate Headquarters To Be Advised Shortly.

In the interim our meeting space is as follows as always:

Berkeley Square House, Berkeley Square, London, W1J6BD (Meeting Space)

350 PPM Ltd is an Appointed Representative of M J Hudson Advisors Limited (FRN: 692447) which is authorised and regulated by the Financial Conduct Authority in the UK

_____________________________________________

Risk Warnings

The value of your investments and the income from them can fall as well as rise. An investor may not get back the amount of money invested. Past performance and forecasts are not reliable indicators of future results. Currency denominated investments are subject to fluctuations in exchange rates that could have a positive or adverse effect on the value of, and income from, the investment. Investors should consult their professional advisers on the possible tax and other consequences of holding such investments.

The opportunities detailed within this website are available for Professional Investors and Elected Professionals only. There is no access to the FSCS. Your capital is at risk if you invest. Please see the full Risk Warning here.