We're not ones to say "We told you so..." at 350, but we're delighted to hear that the COP 21 Climate Change summit has already established that carbon trading from emissions reductions is firmly back at the heart of the global climate change agenda. Regular readers of this blog will know that re-energising the carbon market is the most practical way to address global emissions increases. And more to the point, it's also the fairest way to affect greener, clean development in the developing world. On the opening session in Paris (COP21), Germany, Norway, Sweden and Switzerland announced an [...]

Read MoreThank heavens. The UK renewable boom was started by the pied piper of misguided climate economics (former energy secretary Ed Miliband) and it's now collapsed under its own weight. To misquote Winston Churchill, never in the field of reducing CO2 emissions has so much been wasted by so few. That's not to say the UK renewable sector hasn't had a good run, but from an environmental point of view it has been about as effective as paying people to run round in circles to reduce unemployment. Now there are going to be casualties. Potentially a lot of them, too. [...]

Read MoreThere’s an inherent commercial tension within the way companies approach structuring renewable energy projects. In any new area, there’s naturally an element of trial and error that's characterised renewables for both technology providers, developers and investors (as technologies evolve, as legislative frameworks and policy develops and so on). It comes with the territory in emerging industries. However something that’s often overlooked is the way deal-structuring goes through the same kind of trial and error. In many respects, this area is more critical to the delivery of low-carbon solutions than even the technology itself. To explain the issue simply, [...]

Read MoreHere’s an interesting thought. As the global stock markets are sliding back in the wake of concerns over China’s stock market woes, investors are looking to diversify their holdings and hedge a bit with different kinds of asset. Which is predictable. At times like this, investors look for the chance to buy cheap, weather the volatility and enjoy a bit of upside when it all gets back to normal. And for the more risk inclined, carbon, specifically Certified Emissions Reductions or CERs, might finally be looking like a reasonable punt. Now, admittedly, for some years now CERs have looked like a [...]

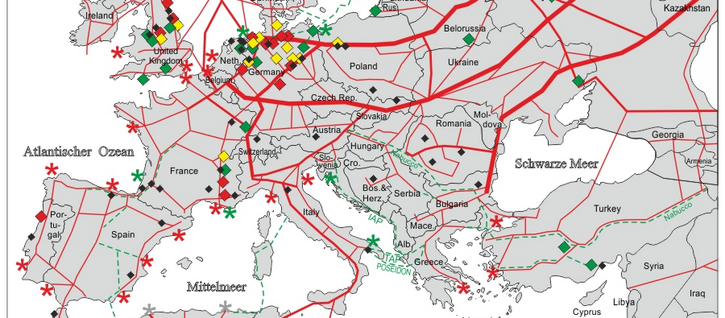

Read MoreI’ve just read a carbon abatement report for a natural gas pipeline that runs across hundreds of miles of continental Eastern Europe. It’s leaking 2.4 millions of tons of methane (CH4) into the atmosphere every year. The equivalent of about 60 million tons of CO2 (going by the standard equivalency measure). And that’s just from one facility in one country. Multiply the issue across the natural gas systems of Europe alone, and the equivalent of billions of tons of CO2 is spewing out into the atmosphere for no reason other than faulty well valves and leaking low-medium pressure pipes. You [...]

Read MoreOn the surface, the latest CMA energy market investigation (Competition and Markets Authority) report appears to be criticising the big six consumer energy suppliers (CMA reports). Consumers have footed a bill between 2009-2013 (the report focus) that’s £1.2bn per year more than they should have paid in a competitive marketplace, the CMA concluded. It has led to rumours of a price cap whilst reforms are made to the energy market. The CMA chairman, Roger Whitcomb was quoted saying “There are millions of customers paying too much for their energy bills - but they don’t have to,” but [...]

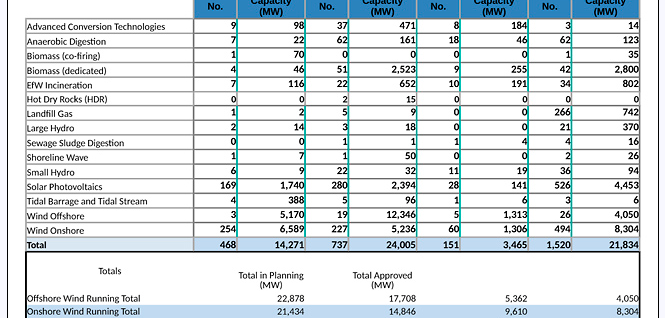

Read MoreLast week the wind industry was shocked (but not exactly surprised) by the government's announcement it would be ending subsidies for onshore wind projects a year earlier than previously promised. It’s a move that potentially threatens thousands of new jobs and places millions of pounds of investment at risk. But what we learn from declining renewable power subsidies is their failure to make low-carbon power a long term commercial proposition without smart grids. Up until now, UK renewable energy policies have been driven by carbon reducing logic. The principles are sound enough, fight climate change by reducing the [...]

Read MoreAs Britain is gripped by election fever it seems the issue of climate change and CO2 reduction has taken a back seat. But rising global CO2 emissions will have a significant impact on the nation’s future health and economic prosperity, so although the c-word isn’t high on the campaign agenda it remains a key underlying issue for the next government. More importantly, assuming the objective of a modern environmental policy should be (in part at least) to reduce carbon emissions, it should be pretty easy to work out which party has got the best offering… right? The story so far: As [...]

Read MoreA couple of days ago, The Centre for Policy Studies released a report titled: Central Planning with Market Features: how renewable subsidies destroyed the UK electricity market. (You can read the report here). The UK press jumped onto this story and it's fair to say I agree with the findings of the report. I have known the root cause of the problem with renewable subsidies for a while: How can solar power really work in the UK market? We don’t get much sun anyway (when it’s not cloudy) and you never really know when it’s not going to be cloudy, which [...]

Read MoreYou’d be forgiven for thinking that green energy, electricity markets and politics appear complicated. A couple of weeks back we saw Greenpeace criticising the UK Government’s UK Export Finance scheme’s decision to loan $1bn in funding packages to a deal including Pemex (the Mexican oil group) calling the coalition government's green credentials into doubt. Last week German electricity giant (and UK ‘big six’ energy supplier) E.ON posted record annual losses blaming subsidised wind and solar for the downward trend in wholesale electricity prices. But we also know the EIS / SEIS tax breaks for investors that [...]

Read More