There’s an inherent commercial tension within the way companies approach structuring renewable energy projects. In any new area, there’s naturally an element of trial and error that's characterised renewables for both technology providers, developers and investors (as technologies evolve, as legislative frameworks and policy develops and so on). It comes with the territory in emerging industries. However something that’s often overlooked is the way deal-structuring goes through the same kind of trial and error. In many respects, this area is more critical to the delivery of low-carbon solutions than even the technology itself. To explain the issue simply, [...]

Read MoreHere’s an interesting thought. As the global stock markets are sliding back in the wake of concerns over China’s stock market woes, investors are looking to diversify their holdings and hedge a bit with different kinds of asset. Which is predictable. At times like this, investors look for the chance to buy cheap, weather the volatility and enjoy a bit of upside when it all gets back to normal. And for the more risk inclined, carbon, specifically Certified Emissions Reductions or CERs, might finally be looking like a reasonable punt. Now, admittedly, for some years now CERs have looked like a [...]

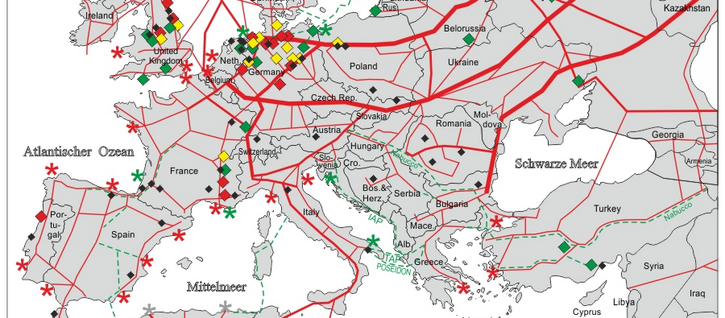

Read MoreI’ve just read a carbon abatement report for a natural gas pipeline that runs across hundreds of miles of continental Eastern Europe. It’s leaking 2.4 millions of tons of methane (CH4) into the atmosphere every year. The equivalent of about 60 million tons of CO2 (going by the standard equivalency measure). And that’s just from one facility in one country. Multiply the issue across the natural gas systems of Europe alone, and the equivalent of billions of tons of CO2 is spewing out into the atmosphere for no reason other than faulty well valves and leaking low-medium pressure pipes. You [...]

Read MoreSolar 350 is pleased to welcome onboard two very experienced project procurement experts to lead our South American business development programme. Axel Schmid will be heading-up our growing deal stream in South America, assisted by Jennifer Rivera Opazo. Together they bring with them the expert local business knowledge and contacts that are essential for operating projects like ours. Our team now brings together Chinese solar industrial partners (led by Bill Goldie) European and American financial partners (led by CFO Justin Passfield) and European engineering and carbon trading services (led by Nick Dimmock and Doug Marett of Grue [...]

Read MoreFollowing-on from last week’s announcement of our partnership with a major Peruvian engineering firm, we’re pleased to formally announce our new plans with Tecnicas Metalicas, headquartered in Lima. Founded in 1979, Tecnicas Metalicas is a heavy engineering firm with a long standing track record in metal (especially steel) fabrication, with both the delivery capacity and resources to make it a leading player in Peruvian infrastructure... and soon to extend their reach (with us) into Peruvian solar development. With a 52,802 sqm fabrication plant (and a processing capacity of 2,400 tons steel per month) they’re firmly established as a major player [...]

Read MoreHot on the heels of bringing on our new CFO, Justin Passfield, Solar 350 can announce we’ve signed agreements with 3 major independent power producers, all of which are exchange-listed entities and of Chinese origin. Obviously we can’t say too much at this point, but we are pleased to confirm we have signed NDNCNS (that’s non-disclosure, non-circumvent, non-solicitation) agreements with a view to developing, building, financing and refinancing utility-scale solar energy projects in Chile and various prime solar locations round the globe. This news means we’re now able to action our Solar 350 staged development & value creation model: Stage 1 [...]

Read More