THE ECONOMIC CYCLE

I subscribe to the 18-year economic cycle theory. I studied Behavioural Finance during my MBA and then completed my Thesis on The Cycle of Investor Emotions.

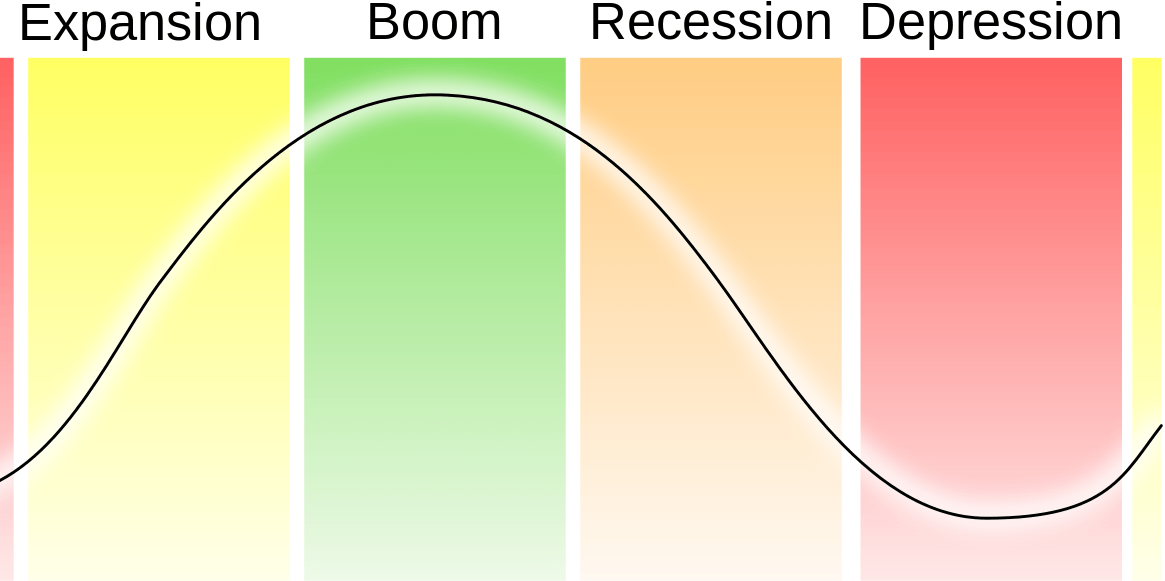

As such, bearing in mind that we remember the last 3 years most clearly, it is no surprise to me that reliably, about every 7 years we (the human race) get ahead of ourselves and every 14 years, every significantly ahead of ourselves.

Most of these shocks start with a crisis of confidence, maybe a fear of heights, but the crisis of confidence is based on some factor or another and at this point everyone realises how crazy everything is getting and the fear machine then feeds on itself in a kind of sickening spiral; a feedback loop if you like.

This generally results in two types of economic shock: a market shock that doesn’t get any government assistance and then a larger shock often related to the housing market that does need government assistance to put things right.

So the dates and times don’t fully conform with the 7-year expansion, hiccup, 7-year expansion and then 4-year recession, but looking at the figures below, you can see that it just about works.

Source1: Nicholas Dimmock, 350 PPM Ltd, based on Google Search: “7 Year Economic Cycle” or google search “18 Year Economic Cycle”.

The a more complete chart detailing just the 18 year intervals, is detailed below:

Source2: The Epoch Times: Economists Explain Why Our Economy Crashes Every 18 Years: http://www.theepochtimes.com/n3/2000510-economists-explain-why-our-economy-crashes-every-18-years/

Obviously there are some considerable events related to specific years here, but it is logical to assume that roughly every seven years, we get ahead of the economy and there is a correction.

This leaves me wondering what will happen to upset the proverbial apple cart in 2017-2018 and how can we (350) prepare ourselves for it.

I have haven’t discounted Brexit totally and this is a very considerable worry, but actually, it doesn’t affect our business and this is more of a domestic problem. The shocks detailed above are much more global.

However, for quite a while the fossil fuel divestment campaign has been gaining strength and is no longer gaining traction just based on environmental, we need to save the planet/tree/forna/flora concerns. Its gaining traction on very significant financial concerns about fossil fuel company valuations:

HYPOTHESIS BASED ON THE PARIS AGREEMENT

My hypothesis (and probably a number of other people’s as well) is as follows:

- The Paris Agreement, which has now been signed by 177 countries, is designed to keep average global temperatures within 2 degrees of pre-industrial times. Source: The Paris Agreement, Article 2, Point 1, A: https://unfccc.int/files/meetings/paris_nov_2015/application/pdf/paris_agreement_english_.pdf

- Because CO2 levels and temperatures are highly correlated, this creates a carbon budget; an amount of CO2e (carbon dioxide and equivalent greenhouse gases) that we can pollute the atmosphere with and still stay under the 2 degrees. Source: National Climatic Data Centre: http://www.ncdc.noaa.gov/paleo/globalwarming/temperature-change.html

- Fossil Fuel companies are partly/mostly valued on the reserves they have in the ground. However, to keep within 2 degrees only about a third of what they have in the ground can be taken out and burnt. Based on this, there is a significant mispricing of these companies. Carbon Tracker: Section 19: https://www.carbontracker.org/wp-content/uploads/2014/09/Unburnable-Carbon-Full-rev2-1.pdf

- As fossil fuel companies represent such a significant portion of our global GDP, the re-pricing may in turn cause a very significant economic shock across all economies. Source: Forbes: http://www.forbes.com/sites/quora/2013/04/03/what-are-the-top-five-facts-everyone-should-know-about-oil-exploration/#22e8fce1127d

- The term used to describe these assets, which make up a fossil fuel companies valuation, yet cannot be utilised and burnt, is Stranded Assets. Source: Carbon Tracker: http://www.carbontracker.org/report/stranded-assets-danger-zone/

OTHER CONTRIBUTORS

Carbon Tracker (http://www.carbontracker.org/) , estimates $2.2 trillion worth of fossil fuel company’s assets are potentially stranded assets. i.e. they can’t be used. And because they can’t be used, they shouldn’t hypothetically contribute to a company’s value. Accordingly, this could mean that fossil fuel companies are mispriced.

And now specific fund management groups are establishing themselves: http://www.theguardian.com/environment/2015/may/06/climate-change-must-be-tackled-by-the-markets-say-city-grandees

In addition, other companies are establishing themselves to help institutional investors manage risk and maximise returns in a carbon constrained world. Further information on one such company can be found here. Source ET Index: http://etindex.com/

Here is the list of divestment commitments gained so far: http://gofossilfree.org/commitments/

Of course these things start slowly, but if you look at a chart of The Dow Jones Oil and Gas Index, there is nothing too impressive here (in my personal opinion).

Source: http://markets.ft.com/research/Markets/Sectors-And-Industries/Oil-and-Gas

RISK WARNING

The information contained in this website is prepared for general circulation and is intended to provide information only. It is not intended to be constructed as a solicitation for the sale of any particular investment nor as investment advice and does not have regard to the specific investment objectives, financial situation, and particular needs of any person to whom it is presented.

In particular, the information contained on this site is not intended for distribution to, or use by, any person or entity in the United Stated of America (being residents of the United States of America or partnerships or corporations organised under the laws of the United States of America or any state of territory thereof) or any other jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject 350 PPM Ltd or any affiliates to any requirement to be registered or authorised within such jurisdiction or country. The information contained herein is not intended to be passed to third parties without our prior content and may not be reproduced in whole or in part, without the permission of 350 PPM Ltd.

The value of your investments and the income from them can fall as well as rise. An investor may not get back the amount of money invested. Past performance and forecasts are not reliable indicators of future results. Currency denominated investments are subject to fluctuations in exchange rates that could have a positive or adverse effect on the value of, and income from, the investment. Investors should consult their professional advisers on the possible tax and other consequences of holding such investments.