Author: Alexander Colvill, Research Analyst at 350 PPM.

MJ Hudson Advisers (FRN:692447) have deemed this text does not constitute a financial promotion.

Executive Summary

- Electricity supply in the UK and around the world is slowly shifting from fossil fuel sources to renewable ones. Most renewable sources are intermittent, only creating energy when the sun shines, or the wind blows. Consequently, we expect it to get much harder to match supply with demand.

- In this research note, we examine this problem and outline possible solutions.

- These include the use of interconnectors (electricity links with neighbouring countries), demand side response, new fossil fuel power stations and grid-scale energy storage. These are all methods of providing flexibility in either demand, or supply, or both. We are likely to need all these solutions to address the sheer scale of the problem.

- We focus in on grid-scale energy storage as what we see to be the most logical, versatile, environmentally-friendly and economic of these. We define grid-scale energy storage as storage which

can provide power on the order of GWs (gigawatts) and energy on the order of GWhs (gigawatt-hours). - Grid-scale energy storage can both store excess electricity (when it is windy, for example), and provide supply when other sources may not be able. We see further adoption of grid-scale energy storage would allow for, speed up, and reduce the cost of, the continued switch to renewables.

- The value of two key revenue sources for grid-scale energy storage are expected to increase – peak / offpeak electricity spreads, and providing balancing and ancillary service to the Electricity Network Operator (National Grid in the UK).

- Estimates for the total market value for energy storage in the UK out to 2050 are on the order of tens of billions of pounds.

- The market internationally is estimated to be 100 times the size.

- The market is estimated to increase a further 3-6 times if storage is used as baseload (constant supply) and ~10 times with the electrification of cars and heating.

- We see only two proven technologies which can provide economic grid-scale storage today, Pumped Hydro Storage (PHS) and Compressed Air Energy Storage (CAES). Batteries are not one of these.

- Pumped Hydro Storage (PHS) is expensive to build, and we see there is limited opportunity to build more in the UK or worldwide.

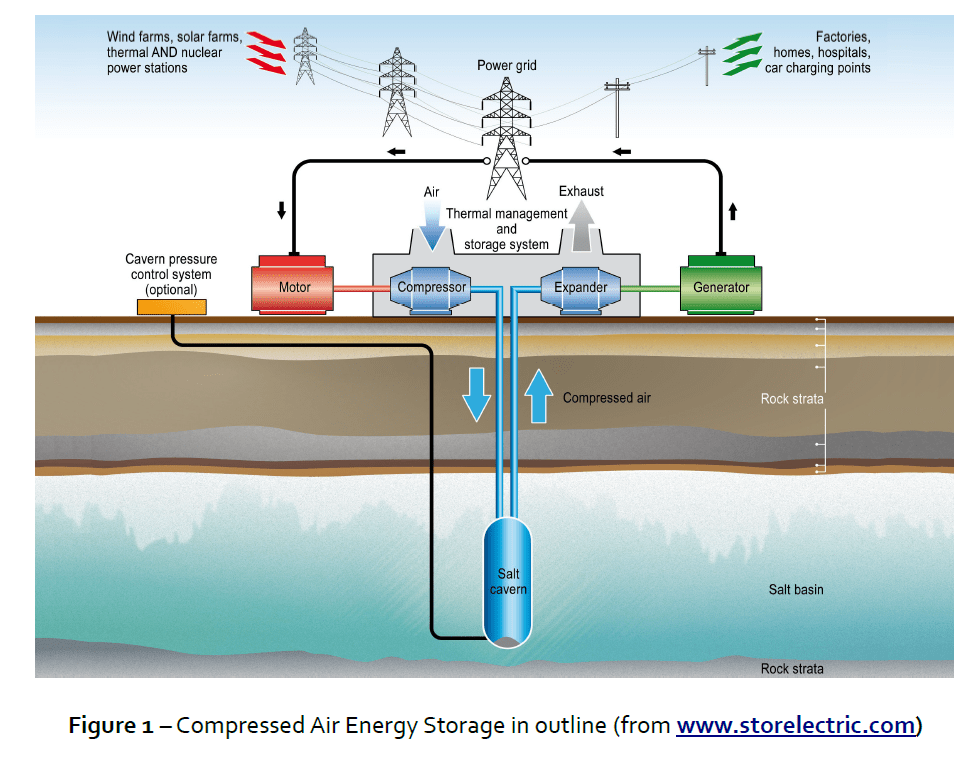

- We see the only alternative as Compressed Air Energy Storage (CAES). CAES stores electricity by compressing air into large underground spaces such as salt caverns. Air is expanded through a turbine to regenerate the electricity when needed. CAES has been in use safely and reliably since the 1970s (up to ~300 MW). New versions of CAES have been developed which are significantly more efficient (hence profitable) and do not burn fossil fuels.

- 350 PPM view grid-scale energy storage – in particular CAES – as a wholly credible candidate for the ‘next big trend’.

The Problem – The Shift to Renewables

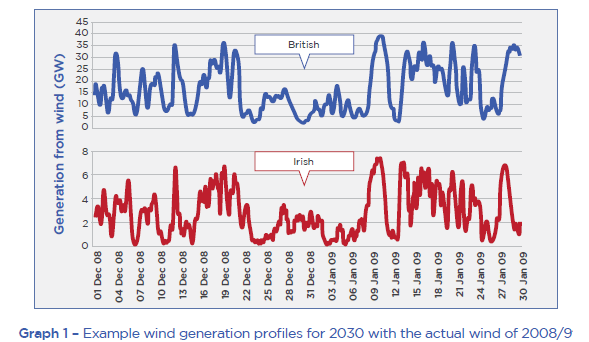

We might not think about it often, but most of us depend on a stable electricity supply system to provide us with the energy we need to run our lives, whenever we want it. This system has to be able to cope with the peak energy demand from all its users, all the time. 350 PPM see this becoming increasingly difficult to do. On the demand side, peak demand could rise significantly over the next few decades[2] as we switch to greener forms of energy, moving from petrol to electric cars, and from fossil fuels to electricity for heating, for example. This switch is government-mandated – as the UK attempts to meet international climate change targets – and increasingly seen as the right thing to do. Even in the most conservative case, peak demand is unlikely to fall[3]. On the supply side, and for the same reasons, there is an ongoing shift from polluting fossil fuel sources – coal, oil and gas – to renewable ones, such as wind and solar, with wind being particularly relevant to the UK. This is only expected to continue in the future[4]. As a result of this, we are expected to move mainly from dispatchable sources – ones that generate electricity when we need it – to intermittent ones, which only generate electricity when the wind blows, the sun shines, waves wave, tides ebb etc. Graph 1, below, highlights the scale of future intermittency in the UK[33]. It shows that power output from UK wind farms in 2030 could vary by as much as 40 GW (gigawatt) on short time scales. This is a massive amount, roughly two thirds of the entire current peak demand[5].

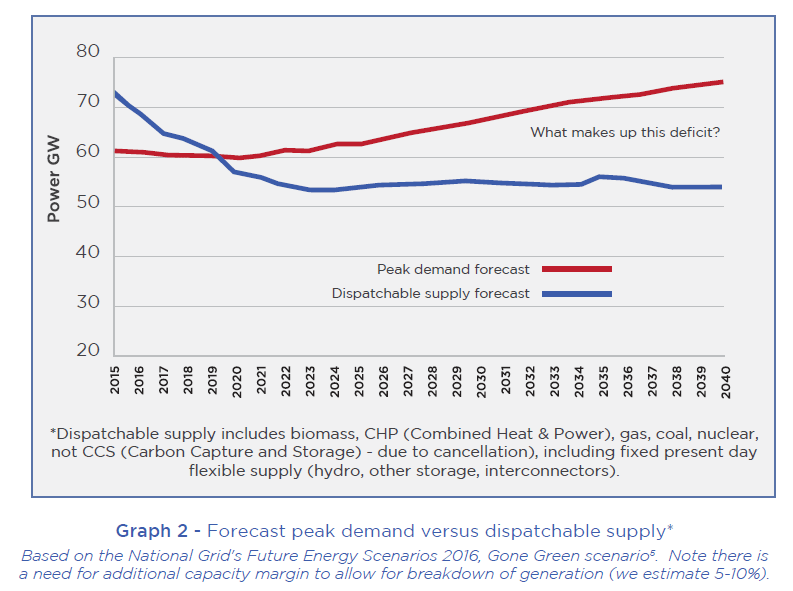

Putting the supply and demand side trends together, we see that – if nothing is done – dispatchable supply is expected to fall below peak demand. See Graph 2 below.

Intermittent sources may make up the deficit some of the time, but this cannot be relied upon, as Graph 1 demonstrates. Some other method must be found. At other times, supply is expected to exceed demand. Currently, this energy cannot be stored on a large scale, as there is only ~3.2 GW of electrical storage in the UK (as of October 2016)[6] . Sometimes, supply has to be curtailed, and is paid for the privilege[7]. Energy that could have been captured is, instead, wasted. More commonly, fossil-fuelled power stations are cycled aggressively to compensate – in this case and the deficit case – leading to increasing costs and emissions and the need for subsidies in the form of the Capacity Market. The Capacity Market is a UK government subsidy aiming to ensure the security of our electricity supply[8].

Current + Proposed Solutions

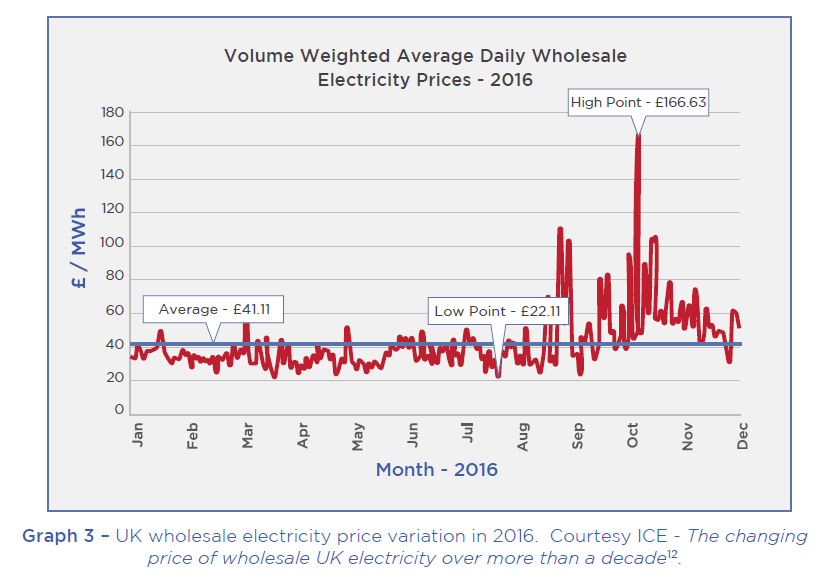

Buying and selling electricity through interconnectors with our neighbours. The need is such that we do this already, but the UK mainland is not currently well connected, having a total capacity of 4 GW[9]. There are plans to build more, but this is expensive and no guarantee of solving the problem; it should be common sense that demand (people are up at the same time) and supply (see Graph 1, for example) tend to match up between neighbouring countries. Ofgem, the gas and electricity regulator, agreed with this analysis in 2013[10]. This method could also make us dependent on our European neighbours, which may not be possible, or desirable post-Brexit. In any case, if our neighbours need electricity when we do, prices tend to go up, sometimes massively so, see Graph 3, below, whose peaks in November were, in part, due to outages in French nuclear generation[11]. 350 PPM see it as preferable to keep our energy supply in country, whilst still retaining the option to sell abroad.

Matching demand to supply, by asking users to adjust electricity consumption when necessary. This is officially known as Demand Side Response (DSR). It can be done automatically, but conceptually it is back-to-front, by its nature can only be employed on short timescales (for example, you can only turn down or off an industrial fridge for so long) and the need is such that we use it already[13]. However, ~87% of demand is inflexible, and therefore cannot be adjusted to supply, and it is unlikely to be economically viable for all the remaining ~13% to participate[14]. Continuing with the fridge example, it may be possible to switch off a fridge once in an evening for a short period, but unlikely twice in quick succession, so this fridge may be able to provide DSR, but not continuous DSR. 350 PPM estimate that, in fact, only 5% of demand is suitable for DSR.

Building new fossil fuel plants to provide the missing supply. This is likely an expensive, non-green solution, completely counter to the UK government’s objective of meeting climate change targets. The plants – most likely gas-powered – would sit idle when not needed and run inefficiently when switched on/off and ramped up/down to meet demand. It is unlikely that anyone would suggest using a nuclear power plant like this.

Storing excess energy when produced. Using this same energy to provide the missing supply. Sound sensible? As explained above, this happens already in the UK, but to a limited extent. The potential is there to massively increase our storage capacity here and worldwide.

Note that storage can act on both supply and demand sides, as can interconnectors; the others act on one side alone. Note also that, although these solutions do compete to some extent, they all work differently and therefore have different uses for which they are naturally most suited. In addition, they can be used in combination. For example, 350 PPM have calculated that storage (of sufficient magnitude) can be used to smooth interconnector flows, greatly increasing their total energy capacity. And DSR can be used to cope with quick-response, short-duration tasks, whilst storage (of sufficient magnitude) takes over on longer timescales. As the problem is considerable in scope, we are likely to need all the solutions, but of all the options, 350 PPM see grid-scale storage as the most logical, versatile and environmentally-friendly. And potentially the most lucrative.

The Grid-scale Energy Storage Solution

The Requirements

Since we have identified the concept as sound, the next question is, can we do it in practice? We see the following attributes are required:

Powerful

The energy storage must be employable on the same scale as the problem: grid-scale. Quantifying exactly what this means is difficult as it involves speculation about future demand and supply profiles. Our simple analysis of Graph 2 shows a need for ~25-28 GW of flexible supply by 2040. Based on the same numbers, the National Grid see up to 15 GW of this being fulfilled by storage by 2040 [15]. Storelectric, a UK company (purveyors of Compressed Air Energy Storage (CAES), see below), see a need now in the UK for 5 GW of storage and for 17-20 GW by 2050. The UK government’s Technology Innovation Needs Analysis (TINA), 2012, sees a central case of 27.4 GW storage need by 2050 [16]. In summary, it is not unreasonable to suggest a need on the order of GWs, growing to tens of GWs out to 2050 in the UK. Scaling up internationally, the need is therefore on the order of TWs (terawatts).

Long Duration

The storage also needs sufficient duration at rated capacity – total energy capacity, in other words – such that it can time-shift energy across a significant proportion of the day; seconds and minutes are not sufficient. One benchmark used is ~5 hours[16]. This is roughly the length of the peak electricity period in the evening. This allows for energy to be stored overnight, for example, and for it to be supplied at maximum output over the entire evening peak electricity period.

Efficient, Long Life

The storage should also be efficient and retain as much energy as possible between charge and discharge. And it should remain efficient over its lifetime, which should be as long as possible. For short term grid services, the storage also needs a quick enough response time, though these can be delivered by the smaller scale technologies such as batteries and DSR (as mentioned previously).

Revenue

As well as possessing these requirements, the storage must be able to provide them economically. Storage has three main revenue streams, two of which we will show are expected to increase in value substantially:

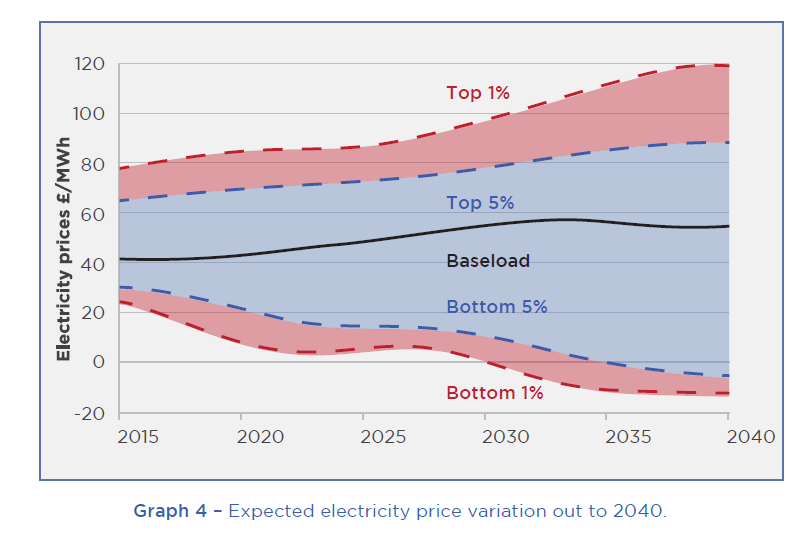

The first revenue stream involves buying electricity at off-peak prices and, using the above time-shift capability, selling at peak prices, which are on average double. Due to increased use of renewables, the spread between the two is growing, and this trend is expected to continue [17]. See Graph 4, below.

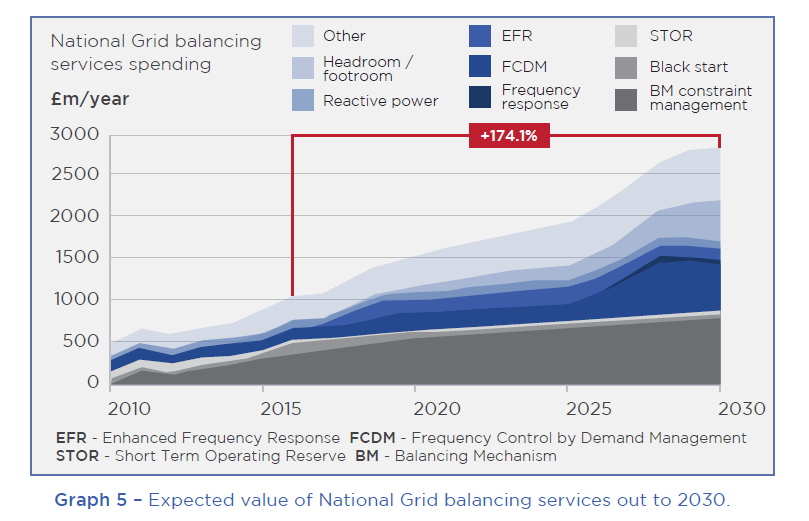

The second revenue stream comes from providing balancing and ancillary services to the Electricity Network Operator (National Grid in the UK). For example, reserve and frequency response services. National Grid confirm that the volume and value of these services is on an upward trend [18]. Aurora Energy Research sees the total value of National Grid services increasing from ~1 billion pounds in 2017, to ~3 billion pounds by 2030 [19], see Graph 5, below.

The final revenue steam is the Capacity Market (mentioned earlier), a government subsidy aiming to ensure the security of the UK’s electricity supply [8]. We see the potential for the introduction of an additional UK subsidy specifically aimed at energy storage, or other market measures which may help storage.

Market Size

Given these economics, what about the potential market size? Indications include:

The UK government’s ‘Technology Innovation Needs Analysis’, 2012, sees ‘value in business creation’ due to energy storage of ~£11.5 billion from 2012 to 2050. It also sees ‘value in meeting emissions targets at low cost’ of ~£4.6 billion. Both of these are central cases, with the upper limit considerably higher [16]. The National Infrastructure Commission report ‘Smart Power’, 2016, projected a possible £8 billion saving to the UK, per year, by 2030 if storage and flexibility measures are introduced on a large scale [20]. Most relevant perhaps, Storelectric – the UK storage company mentioned previously – quote a figure of ~£16 billion for the value of the UK energy storage market over the next 10-15 years [21]. They see the international market as being 100 times the UK market. In addition, they estimate that the storage market expands by 3-6 times if storage is used as baseload (constant supply), rather than simply coping with

renewable peaks, and a further ~10 times with the electrification of cars and heating [22].

Grid-Scale Storage Technologies

We see only two proven technologies which can economically provide this specification of grid-scale storage today. Batteries are not one of them (see below). Both technologies can be 100% renewable and we see that they allow for, speed up, and reduce the cost of, the continued switch to renewables. To clarify where the cost saving is expected to come from, if grid-scale storage takes the cable from a large intermittent generator (e.g. a wind or solar farm) then it can reduce the size of the generator’s grid connection by a factor of two or three. This will be reflected in both capital and operational (grid access charging) costs. Moreover, the value of electricity generated is increased due to its dispatchability.

Pumped Hydro Storage (PHS) is expensive to build[23] and Storelectric see limited opportunity to build more in the UK and worldwide, due to topographical limitations. The British Hydropower Association (BHA) also only see a total commercially and technically viable potential of ~800-900 MW across the UK[24]. PHS works by pumping water against gravity, then regenerating it by allowing water to fall through a turbine. PHS locations tend to be far from both supply and demand – meaning the expensive construction of transmission lines to reach them, and the transmission losses associated with these – and there are environmental considerations too18. Most of the world’s current energy storage capacity is PHS[25], so this is a relatively mature market.

We see Compressed Air Energy Storage (CAES) as the only current alternative. It is significantly cheaper than PHS to build [23]. CAES stores electricity by compressing air into large underground spaces such as salt caverns, aquifers or depleted oil/gas fields. Air is expanded through a turbine to regenerate the electricity when needed. See Figure 1, below. It has been in use safely and reliably since 1978 in Germany (321 MW) and 1991 in America (110 MW) [26], but is currently experiencing a renaissance. This is due to the above revenue stream improvements, and the development of new technology which increases the efficiency of CAES plants from 42-50% (electricity out to all energy in), to ~70% [26]. This increases potential profitability. This advance, known as adiabatic CAES, is also 100% renewable, whereas existing plants burn considerable amounts of gas (for example, the McIntosh CAES plant burns 60-70% of the gas of a conventional gas plant [27]). In the UK, Storelectric are the only company we are aware of with the technology (patents pending) and ambitions to build an adiabatic CAES plant in the near term.

Most existing battery storage projects can only store or generate power on the order of tens of MW, for durations of tens of minutes maximum [28]. This does not match the specification above. Batteries current use is limited to quick-response, short-duration applications. Costs are one issue, which are falling, but are not expected, for example, to make lithium ion batteries viable until 2019 at the earliest, with the consensus at 2027, though, on historical learning rates, further out still [29]. Batteries also have lifetimes on the order of a third that of a CAES plant, and efficiency tends to go down over the course of this life, whilst CAES plants can operate near peak efficiency their whole life [30]. Even Tesla, having just announced the development of a 100 MW battery, are not sure they can actually make it [31]. This is not an issue with PHS or CAES on the order of hundreds of MW. We know these can be built. They exist already, as explained in the previous

section.

But what about distributed storage, or hydrogen storage?

Distributed storage is already used to some extent. In the future, it is certainly possible that we all use our electric cars as one giant distributed storage device (known as ‘vehicle-to-grid’), though there are doubts over whether this will ever be commercially viable [32]. And it is certainly possible that each of us ends up with a small battery in our smart homes. Would these solve the problem? Unlikely on their own, as these batteries would still need the grid to charge and to provide backup – so we see the need for grid-scale storage is still there – and how do we cope before distributed storage takes off, if ever? We see that the two do, and will, co-exist quite happily.

Over decades, we could well transition into the ‘hydrogen economy’. We may all drive around in hydrogen cars – rather than electric ones – and we may pump hydrogen around our existing natural gas lines and heat our homes with the stuff too. Under these circumstances, it may make sense to store electricity in hydrogen form (known as ‘power-to-gas’). Currently, hydrogen storage is only really under development for cars, and efficiencies are low.

But what about X, and what about Y?

This is a short report and we have not covered all possible storage technologies. No-one knows if any of these as yet unproven technologies will ever be able to meet the sheer scale of the challenge and do so economically. But when there are proven, profitable, 100% renewable options available today, we may not need to know. There are technologies and companies that are investable now and these should be the focus for investors.

References

- NA

- Page 34, Gone Green scenario of National Grid’s Future Energy Scenarios 2016 (note that most of this was written prior to the 2017 version coming out). ww2.nationalgrid.com/WorkArea/DownloadAsset.aspx?id=8589941573

- See 2, page 34, Slow Progression scenario.

- See 2, chapter 4.

- See 2, the numbers used come from the worksheet version of Figure 4.1.2, page 88.

- www.r-e-a.net/news/new-data-shows-extent-of-existing-energy-storage-deployment-and-planned-projects-in-the-uk

- See, for example – www.dailymail.co.uk/news/article-2088196/Wind-farms-paid-25million-NOT-produce-electricity-blustery.html

- For a brief introduction to the Capacity Market see the opening paragraph of the following – http://business.engie.co.uk/wp-content/uploads/2016/07/capacitymarketguide.pdf

- https://www.publications.parliament.uk/pa/ld201415/ldselect/ldsctech/121/IMG00010.gif

- Ofgem Electricity Capacity Assessment Report, 2013, page 13

…at the moment, there are no evident complementarities between GB and its interconnected markets as we have very similar patterns of demand and supply availability.

https://www.ofgem.gov.uk/sites/default/files/docs/2013/06/electricity-capacity-assessment-report-2013_0.pdf - Note that in November 2016, with only 4GW of interconnectors (of which, 2GW with France (www.ofgem.gov.uk/electricity/transmission-networks/electricity-interconnectors), when the French nuclear industry suffered a combination of both planned and unplanned outages, all neighbouring countries were significantly affected and electricity imbalance prices shot up to beyond £1,500/MWh at one point (with many other, lower, peaks) as against normal average prices of £30-60/MWh – www.cornwall-insight.com/newsroom/all-news/imbalance-prices-hit-1-500-mwh-last-week-what-happened – and www.ice.org.uk/news-and-insight/the-civil-engineer/february- 2017/what-caused-the-recent-spike-in-power-prices . National Grid is planning (depending on scenario) to rely on interconnectors for between 20 and 25% of all peak demand (figure 4.2, page 56, Future Energy Scenarios 2017, see 37.

- www.ice.org.uk/knowledge-and-resources/briefing-sheet/the-changing-price-of-wholesale-uk-electricity

- See 2, section 3.5.1.

- http://powerresponsive.com/wp-content/uploads/2017/05/Aurora-Energy-Research-Investor-Event.pdf

- See 2, section 4.3.

- UK Government’s Technology Innovation Needs Assessment (TINA), 2012:

http://lowcarboninnovation.co.uk/working_together/technology_focus_areas/electricity_networks_storage/ - https://policyexchange.org.uk/power-2-0-the-policy-exchange-smart-power-report-in-7-key-charts

- National Grid System Operating Framework (SOF) 2016, 1.2 Key Messages – Distributed generator outputs and interconnector flows increase in size & variability throughout the decade assessed for SOF 2016. Large generators & other interconnectors will have to operate more flexibly to accommodate this, complemented by growth in balancing tools and technologies such as energy storage & flexible demand. www2.nationalgrid.com/WorkArea/DownloadAsset.aspx?id=8589939111. See 2, section 5.3: The sensitivities all show that flexibility and balancing requirements on the gas and electricity systems will increase from today’s level.

- http://powerresponsive.com/wp-content/uploads/2017/05/Aurora-Energy-Research-Investor-Event.pdf

- National Infrastructure Commission Report, ‘Smart Power’, 2016, page 7: https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/505218/IC_Energy_Report_web.pdf

- http://storelectric.com/faq.html

- http://storelectric.com/energy-storage.html

- Relative costs PHS versus CAES can be found on page 23 of the following – www.ecofys.com/files/files/ecofys-2014-energy-storage-white-paper.pdf

- The figure of ~800-900 MW is a sum of the summary figures from the 2008 Scottish Hydro Resource Study and the 2010 England and Wales Hydro Resource Study, available at: http://www.british-hydro.org/hydro_in_the_uk/uk_hydro_resource

- See, for example, the US Department of Energy’s Global Energy Storage Database – www.energystorageexchange.org/projects

- For existing plants, this can be verified by visiting the US Department Of Energy’s Global Energy Storage Database. If you filter the technology by Technology Type ‘Electro-mechanical’, and status ‘Operational’ the two mentioned CAES plants will be found. Efficiency statistics are given. http://www.energystorageexchange.org/projects. For the Storelectric adiabaitc CAES efficiency number, see : http://storelectric.com/index.html

- Expand the description at: http://www.energystorageexchange.org/projects/136

- This can be verified by visiting the US Department of Energy’s Global Energy Storage Database. If you filter the technology by Technology Type ‘Electro-chemical’, and status ‘Operational’ it can be noted that the largest battery projects are on the order of 10s of MW, with durations mostly on the order of minutes. http://www.energystorageexchange.org/projects

- http://powerresponsive.com/wp-content/uploads/2017/05/Aurora-Energy-Research-Investor-Event.pdf

- http://www.apexcaes.com/technology-overview

- Saturday Telegraph, 15/07/17, Business Section.

- National Grid’s Future Energy Scenarios 2017, page 47: http://fes.nationalgrid.com/media/1244/final-fes-2017-interactive.pdf

- www.poyry.com/sites/default/files/impactofintermittencygbandi-july2009-energy.pdf