Last week the wind industry was shocked (but not exactly surprised) by the government’s announcement it would be ending subsidies for onshore wind projects a year earlier than previously promised. It’s a move that potentially threatens thousands of new jobs and places millions of pounds of investment at risk. But what we learn from declining renewable power subsidies is their failure to make low-carbon power a long term commercial proposition without smart grids.

Up until now, UK renewable energy policies have been driven by carbon reducing logic. The principles are sound enough, fight climate change by reducing the sources of carbon emissions through a stick and carrot approach: Incentivise renewable sector growth (with subsidies and tax breaks for investors) whilst simultaneously regulating electricity supply, forcing distributors to adopt a proportion of renewable sources into their energy supply mix or face penalties.

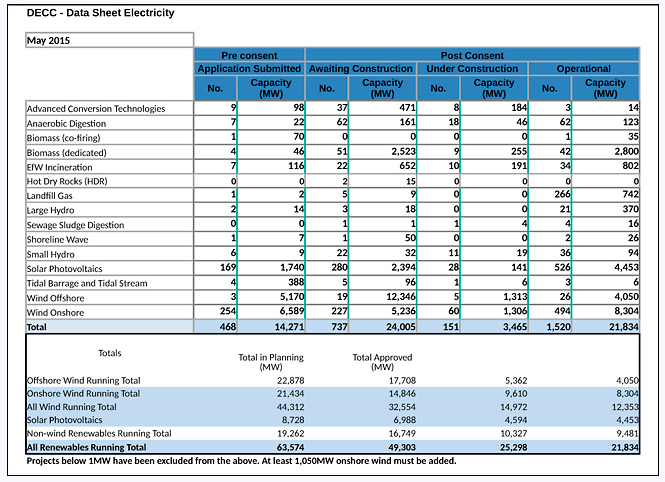

The anticipated result was a shift to cleaner energy, but in reality what’s happened is destabilisation of the energy market. It’s driven investment in renewable tech and proliferation of renewable sources but it’s also created multiple certification schemes, electricity supply problems and an artificial internal market for renewables that is driving costs up for consumers. At the same time, it’s pushed fossil fuel sources to reduce capacity and even close down. This situation is complicated by the low price of carbon permits and offsets, which means the fossil burners can afford to keep polluting. It’s a lose: lose scenario. We lose on the environmental front because carbon emissions are dropping slower than we need them to, and the destabilised energy market means we face an energy crisis in the not-so-distant future.

At the root of the problem is the UK’s ageing electricity grid architecture. It was designed to service a continuous power supply from fossil fuels. There’s no utility scale energy storage capacity, so the old fashioned grid can’t fully utilise power from renewable sources because the nature of solar, wind and tidal power isn’t continuous, it’s intermittent.

For example: When everyone boils their kettle on Monday morning for breakfast, the base-load demand on the grid increases. If there’s sub-optimal wind and solar power being supplied, there will be brown-outs. By the same token at 3 am when it’s howling a gale and wind power is high but demand is low, the unused power goes to waste. The grid can’t save that power and deliver it the next morning to avoid the breakfast brown-out scenario. Without utility-scale energy storage systems, wind in locations that aren’t constantly windy (and solar in locations that aren’t consistently sunny) become grid-dysfunctional because energy supply and energy demand are out of synch.

Nick Dimmock, 350’s MD sums up the problem:

“As we know from the Centre for Policy Studies report published in March, subsidised wind and solar power have done relatively little to fight global warming, and have led to the destabilisation of the UK energy market. In theory, renewable energy addresses the fossil-fuel emissions problem, but without either a constant supply of renewable energy power or smart grids and storage technology, it can’t practically address the carbon emissions issue at all. ”

The UK has arrived at a crossroads, but eventually, all developed economies will face this same problem. There are solutions but they’re getting scant policy backing. Put all the world’s batteries end to end and you’ll be able to power the global economy for less than 5 minutes and it’s both phenomenally expensive and will only function for around 500-1000 cycles using Nickel Cadmium or Lithium Batteries. We know that rooftop solar and wind, combined with home battery storage can be marginally effective but it cannot get near the variations in power needed to electrify the national grid. Home batteries might give a couple of days off-grid grace before they need some significant sun or wind for a top-up, but if the climate doesn’t deliver, they’ll need to be on-grid to keep the lights on.

We also know that utility scale storage like CAES (compressed air energy storage) have got real potential and our engineering partners; Grue and Hornstrup is already working with systems like this to assess their real world applicability. At 500MW, these do provide grid storage capacity the UK badly needs but deployment requires greater investment and upgrades to the grid architecture, which is a slow process.

The lesson of the onshore wind subsidy-cut is clear. The shift from fossil fuels to renewables may have started as an environmental initiative, but in practical terms it’s highlighted either the off-grid storage problem and utility-scale grid storage problem. In both cases, the energy industry needs to make a lot more profit to finance the new mix of solutions, not rely on subsides nor operate in a dysfunctional marketplace. And given the need to solve the storage issue, the basic economic model of renewable energy generation we have at the moment is missing some critical elements.

It’s a fork in the road for energy policy, one which splits between storage capacity built on economic expansion of the energy sector, or a carbon-fuelled climate crisis. If we want to avoid the latter, we need a policy that prices carbon emissions higher and incentivises commercially profitable solutions to climate change, which means encouraging investment and R&D in smart grids with utility-scale storage. Renewable energy sources would be commercially competitive against fossils if they could sell carbon credits at a decent price and sell the electricity they generate at 3am in the morning rather than waste it. Wind maybe the cheapest of the renewable technologies but without appropriate storage, it’s more supplement to fossils, not a like-for-like replacement.

We’ve got no shortage of renewable power in terms of tidal and wind, we simply lack the infrastructure and economic conditions to extract the value from it.