We're not ones to say "We told you so..." at 350, but we're delighted to hear that the COP 21 Climate Change summit has already established that carbon trading from emissions reductions is firmly back at the heart of the global climate change agenda. Regular readers of this blog will know that re-energising the carbon market is the most practical way to address global emissions increases. And more to the point, it's also the fairest way to affect greener, clean development in the developing world. On the opening session in Paris (COP21), Germany, Norway, Sweden and Switzerland announced an [...]

Read More"With so many renewable projects out there, you’ve got to apply some pretty strict criteria to separate out the best opportunities from the riskier ones. That’s our challenge..." This week I managed to pin down our busy Business Development Director, Bill Goldie to get a run down of the 350 projects we’re engaged with. In between trips to China, India and Mexico, he explained his number one priority for selecting a renewable energy projects: “Generally, the projects we work on are exceptionally high quality in terms of their development potential, and based in countries that are transitioning from developing to [...]

Read MoreThank heavens. The UK renewable boom was started by the pied piper of misguided climate economics (former energy secretary Ed Miliband) and it's now collapsed under its own weight. To misquote Winston Churchill, never in the field of reducing CO2 emissions has so much been wasted by so few. That's not to say the UK renewable sector hasn't had a good run, but from an environmental point of view it has been about as effective as paying people to run round in circles to reduce unemployment. Now there are going to be casualties. Potentially a lot of them, too. [...]

Read MoreOne of the issues that we face when looking for power projects offering the best carbon reductions is selecting the right location for a project. This has always led us to look at the developing world, because that’s where emissions are rising, and rising fast. In effect, the world is no longer developed or developing, there are really about 5 grades from developed, transitioning, developing, under developed and least developed. There’s little carbon benefit from developing in Europe and it's very expensive because power prices are so low. The evidence for this is obvious; the installed capacity in EU and [...]

Read MoreThere’s an inherent commercial tension within the way companies approach structuring renewable energy projects. In any new area, there’s naturally an element of trial and error that's characterised renewables for both technology providers, developers and investors (as technologies evolve, as legislative frameworks and policy develops and so on). It comes with the territory in emerging industries. However something that’s often overlooked is the way deal-structuring goes through the same kind of trial and error. In many respects, this area is more critical to the delivery of low-carbon solutions than even the technology itself. To explain the issue simply, [...]

Read MoreWe’re delighted to announce we’re making the last few preparations to launch our first Deal Stream 2 project, planned to break ground mid-2016 in Chile’s South Atacama desert. The project is for a sub-50MW solar energy facility that meets all the requirements for delivering a high quality, profitable solar park with excellent long term revenue potential. The key to building high quality renewable energy assets that deliver both effective carbon reductions and offer long term value creation for investors is defining the right kind of project. This first Atacama solar development is an excellent example: Location: [...]

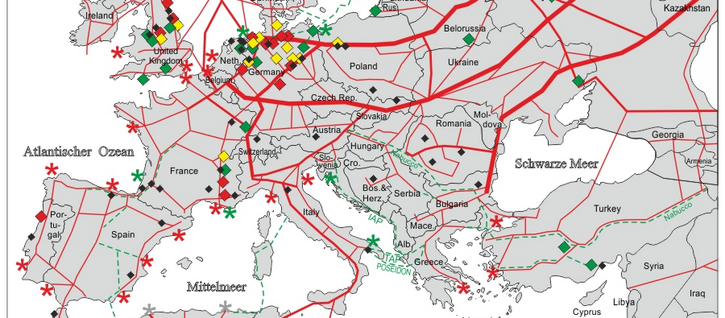

Read MoreI’ve just read a carbon abatement report for a natural gas pipeline that runs across hundreds of miles of continental Eastern Europe. It’s leaking 2.4 millions of tons of methane (CH4) into the atmosphere every year. The equivalent of about 60 million tons of CO2 (going by the standard equivalency measure). And that’s just from one facility in one country. Multiply the issue across the natural gas systems of Europe alone, and the equivalent of billions of tons of CO2 is spewing out into the atmosphere for no reason other than faulty well valves and leaking low-medium pressure pipes. You [...]

Read MoreWe have a theory about the Chinese stock market crash. And it’s just that, a theory because as anyone who studies the Chinese economy knows, there’s a certain lack of transparency in the data that makes it difficult to pinpoint the real reason why the market has been lurching downward in recent months. But one thing is pretty much certain, it's not a crash. In fact, it's doesn't look like a market correction either. China’s recent stock market slump has provoked a lot of speculation about the cause. Over the last few years, many commentators have suggested Chinese banks [...]

Read MoreOn the surface, the latest CMA energy market investigation (Competition and Markets Authority) report appears to be criticising the big six consumer energy suppliers (CMA reports). Consumers have footed a bill between 2009-2013 (the report focus) that’s £1.2bn per year more than they should have paid in a competitive marketplace, the CMA concluded. It has led to rumours of a price cap whilst reforms are made to the energy market. The CMA chairman, Roger Whitcomb was quoted saying “There are millions of customers paying too much for their energy bills - but they don’t have to,” but [...]

Read MoreSolar 350 is pleased to welcome onboard two very experienced project procurement experts to lead our South American business development programme. Axel Schmid will be heading-up our growing deal stream in South America, assisted by Jennifer Rivera Opazo. Together they bring with them the expert local business knowledge and contacts that are essential for operating projects like ours. Our team now brings together Chinese solar industrial partners (led by Bill Goldie) European and American financial partners (led by CFO Justin Passfield) and European engineering and carbon trading services (led by Nick Dimmock and Doug Marett of Grue [...]

Read More