The Energy Storage Global Conference 2024 (ESGC), organised in Brussels by EASE – The European Association for Storage of Energy, as a hybrid event, on 15 - 17 October, gathered over 400 energy storage stakeholders and covered energy storage policies, markets, and technologies. Experts from across the energy industry emphasise the importance of energy storage to enhance grid flexibility, support renewable integration, and promote industry decarbonisation. Throughout the conference, speakers emphasised that energy storage is no longer a secondary technology but a central enabler of Europe’s future energy system. Various energy storage technologies were identified as critical for providing flexibility at different time intervals, from [...]

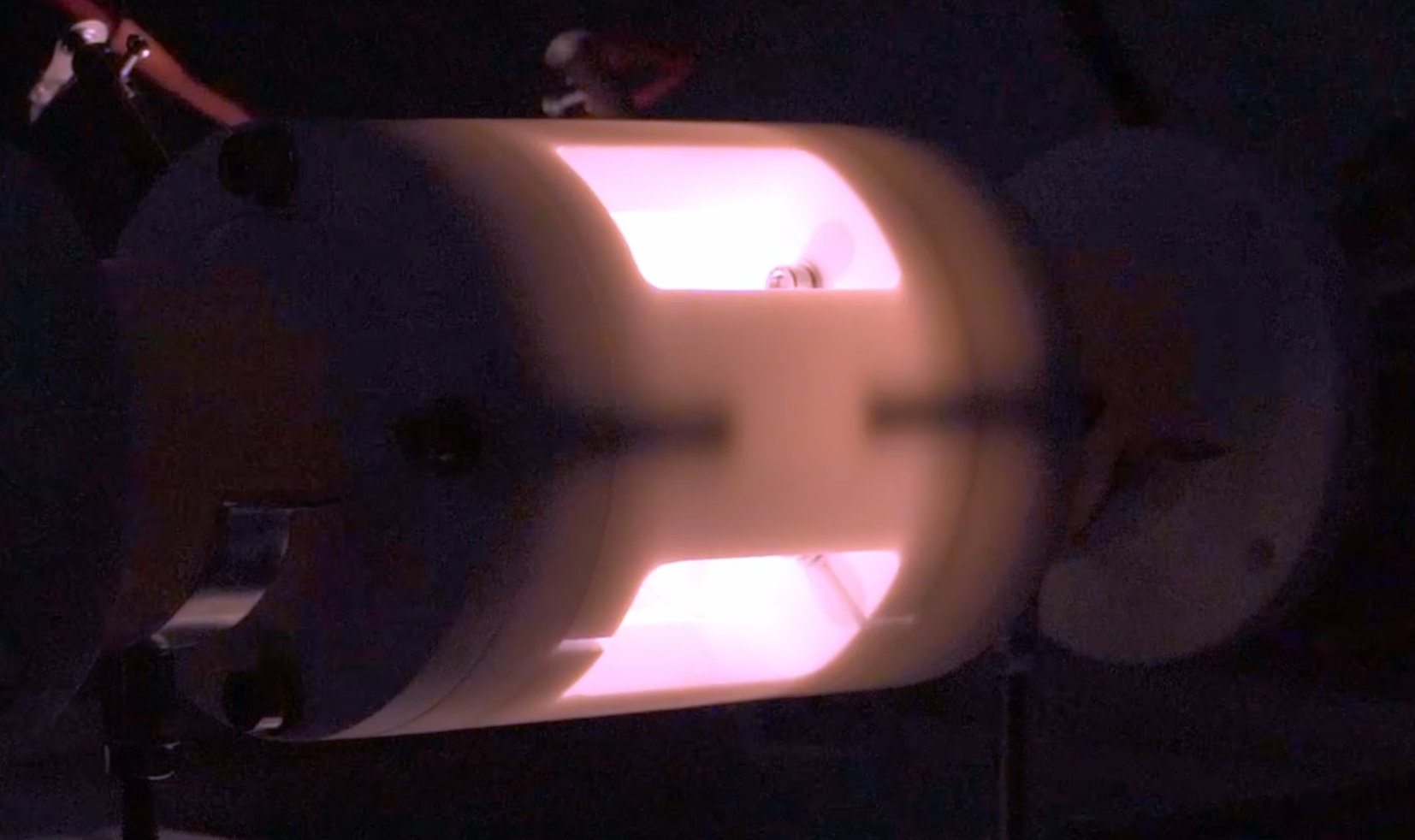

Read MoreA self-powering fusion reactor producing excess electricity Catalysed fusion specialists at ENG8 International have confirmed the results of the recent independent validation of its EnergiCell®, conducted by world-renowned LENR (low energy nuclear reactions) expert Dr Jean-Paul Biberian. The validation showed that the system can be self-powering and export net electricity. Dr Jean-Paul Biberian said: “We can consider that the device can operate indefinitely without any external input power.” Dr Biberian was commissioned by an investor to conduct technical due diligence on an EnergiCell®. His report concluded that: “The technology is capable of sustained operations producing kilowatts of output energy, with a net three times [...]

Read MoreWe’re proud to have been accepted onto the fifth cohort of London & Partners' Grow London Global international expansion programme! Nick Dimmock, Chairman and Head of Investor Relations at 350 PPM, said: “Working with exciting environmental tech start-ups inevitably means we are operating on a global stage to help meet climate targets, and the London Global international expansion programme provides us with a platform to springboard these innovative businesses to reach the corners of the world when they are needed most. “We’re looking forward to connecting with like-minded entrepreneurs on the forthcoming programme and unlocking more international markets.” During the next 12 months, we’ll [...]

Read MoreWe’re proud to announce that 350 PPM has been accepted as an official signatory for the internationally-recognised Principles for Responsible Investment. This demonstrates our commitment and positions us at the heart of a global community seeking to build a more sustainable financial system. Developed by investors, for investors, the six Principles for Responsible Investment offer a menu of possible actions for incorporating ESG issues into investment practice. In implementing them, signatories contribute to developing a more sustainable global financial system. We also recognise that applying these Principles may better align investors with the broader objectives of society. As an official signatory, we are [...]

Read MoreWe work with some of the most exciting early-stage environmental innovators as clients, supporting their businesses to become established, commercialise, grow and expand across the globe. And this takes a real team effort. With our support around them, exponential growth is expected as they gear up to seize the massive market opportunities in the green economy. We invite others to join this journey and our clients offer a success fee of up to 5%, plus bonus shares, on new introductions who invest. For the avoidance of doubt, the referral scheme works between referring entities and our client companies. Through our network, we can [...]

Read MoreWe joined the Rt Hon Chris Skidmore, Chair of the Climate Action Coalition, and Secretary Jennifer Morgan, Germany’s Special Envoy for International Climate Action for the online launch of the Climate Action Coalition today. The Climate Action Coalition is a mission-driven initiative bringing together a global community of organisations committed to achieving our 2030 climate and nature goals. Nick Henry, Founder & CEO of Climate Action, said: "I was delighted to launch the Climate Action Coalition at the Climate Innovation Forum alongside Chris Skidmore and John Kerry – two heavyweight champions in the fight against climate change. The Coalition is an [...]

Read MoreWednesday 17th July 2024, 12.00 – 13.30hrs (UK time). TEAMS online event with live Q&A.REGISTER HERE. Agenda: Introduction and welcome from Nick Dimmock, Head of Investor Relations at 350 PPM Management team introductions from Taus Nöhrlind, Bjørn Zebitz and Paul Vousden Presentation of EnviraBoard product, opportunity and business plan Overview of investment opportunity and structure Q&A Event overview We have announced our plans to bring a carbon-negative building board to the construction industry. Utilising recycled paper sludge, otherwise destined for landfill or incineration, as a raw material, the EnviraBoard product offers both a solution to the waste disposal challenges in the paper recycling industry, and a new, sustainable, and totally [...]

Read MoreWe’re delighted to have been invited to attend the World Family Office Institute’s GCC & Europe Alternative Investment Forum 2024 at Armourers' Hall, London this week. The theme was “Embracing Global Opportunities: The Evolution and Impact of Alternative Investment in a Globalised Economy.” The packed agenda included sessions on global innovations in alternative investments, cross-border VC strategy and innovation in alternative investment, and current trends in hedge fund investment and ETFs. The World Family Office Institute (WFOI), headquartered in the UAE, is dedicated to uniting family offices from the Middle East, Europe, and Asia with the goal of fostering robust financial communication and collaboration. [...]

Read MoreWe were delighted to host so many of our brilliant clients and the wider industry and investor network in the Steward’s Enclosure at the Henley Royal Regatta this year. The weather was perfect, the company outstanding, and the nail-biting competition on the water was as exciting as ever.The event also marked the launch of EnviraBoard – an innovative new carbon-negative building board manufacturing business that we are supporting here in the UK.

Read MoreEnviraBoard launches first carbon-negative building boards The UK-based manufacturer, EnviraBoard, has announced its plans to bring a carbon-negative building board to the construction industry. Using proven Danish technology (IP acquired) EnviraBoard utilises recycled paper sludge as the raw material for its sustainable building boards, which are aptly named “EnviraBoards”. This paper sludge, which is a secondary waste material that would usually end up in landfill or incineration, is free from toxins and is environmentally safe. From waste to value The EnviraBoard product offers both a solution to the waste disposal challenges in the paper recycling industry, and a new, sustainable, and totally circular alternative [...]

Read More