As industries seek smarter, more sustainable energy solutions, the integration of cold thermal energy storage (CTES) with solar photovoltaic (PV) systems presents a powerful opportunity. By converting excess solar power into stored cooling energy, businesses can significantly lower electricity costs, enhance system efficiency, and support their decarbonisation goals. The Case for Cold Storage in Solar Applications Solar PV systems often generate surplus energy during daylight hours—energy that, without storage, may be underutilized. CTES offers an elegant way to preserve this energy in the form of cold, using: Ice Chilled water Advanced phase change materials (PCMs) This stored energy can later be used to meet cooling demands, [...]

Read MoreICCF26 is in full flow, with top universities and physicists sharing major LENR breakthroughs, including the University of Cambridge, MIT and leading researchers from Japan, China, India and across Europe. Professor Bin-Juine Huang (National Taiwan University) presented compelling results from a water cavitation reactor showing LENR reactions with isotopes, atomic transformations and excess heat, reinforcing the performance of ENG8’s EnergiCell®, which delivers significantly higher COP and generates valuable materials. Lynn Bowen (Chairlady of ISCMNS) spoke on emissions from LENR reactors and safety. ENG8 will implement additional sensors in response to her findings. Professor Visotskyi (Taras Shevchenko National University of Kyiv) outlined a theoretical [...]

Read MoreAt 350 PPM, we're dedicated to incubating and accelerating top-tier environmental businesses, aiming to reduce atmospheric CO₂ to 350 parts per million. We're currently raising investment funds for expansion and are looking to collaborate with experienced brokers and introducers to connect us with potential investors. Our Clients: ENG8: Innovators in next-generation energy solutions. EnviraBoard: Pioneers in sustainable building materials. EIS advanced assurance. O-Hx: Leaders in energy-efficient cooling technologies. EIS advanced assurance. What We Offer: A success fee model: success fees, the highest in the industry, are paid in cash and shares by the raising company. A portfolio of high-potential, environmentally focused companies. A commitment to compliance and ethical [...]

Read MoreWe’re thrilled to report major progress on our mini production plant in Denmark! From structural upgrades to critical installations and strategic partnerships, this is the first step in a scalable roll-out across Europe and the UK. This facility is key to demonstrating how commercial waste can be transformed into high-performance, low-carbon building boards (an alternative to plasterboard). With infrastructure upgrades nearly complete and production trials approaching, we're laying the groundwork for rapid growth and investor returns. Full update here: https://enviraboard.com/max-progress-for-enviraboards-mini-plant-in-denmark/ Follow us on LinkedIn for regular updates on our mission, progress, and investment opportunities: https://lnkd.in/evrAAJD9 For more information on how to invest: https://enviraboard.com/register/

Read MoreDelighted to see 350 PPM Ltd, topping the list of UK Green Tech and Climate Tech accelerators on Adopter.net’s fantastic new map: https://www.adopter.net/map-of-uk-green-tech-climate-tech-accelerators-and-incubators Huge thanks to the Adopter team for pulling together such a brilliant resource for anyone navigating the UK’s climate innovation scene. Definitely one to bookmark. From carbon-negative building boards to low energy nuclear reactions to cool energy storage and agritech, our portfolio is poised to make significant impacts in the fight against climate change and leading to significant value creation. Long may this continue.

Read MoreHave you ever wondered what one of the UK’s largest data centres spends on electricity each day? The answer might surprise you — approximately £148,000 per day, with around 50% of that cost attributed to cooling alone. With Organic Heat Exchangers (O-Hx), we’ve been working on a smarter, more efficient solution. Through a special purpose electricity tariff, we’ve developed — featuring rates of 24p/kWh peak and 6p/kWh off-peak, with 12 hours of off-peak availability — data centres now have the opportunity to cut their cooling costs by up to 75%. Interested? Visit O-Hx 350 PPM electricity tariff. Unlocking more than just savings Our Energivault® [...]

Read MoreWhilst the Covid-19 pandemic had an impact on the PAPA One business plan, the greatest obstacle to its progress has been Mexican President, Andres Manuel Lopez Obrador’s, regressive and stymying approach towards the energy sector. The experienced team at PAPA One has operated in many challenging environments with government interventions both positive and negative, mainly focused on subsidies or initiatives, but has never been confronted by a government so determined to halt all private and international business activity in such a key sector. And PAPA One is not alone. Some of the largest international power companies and solar developers have had [...]

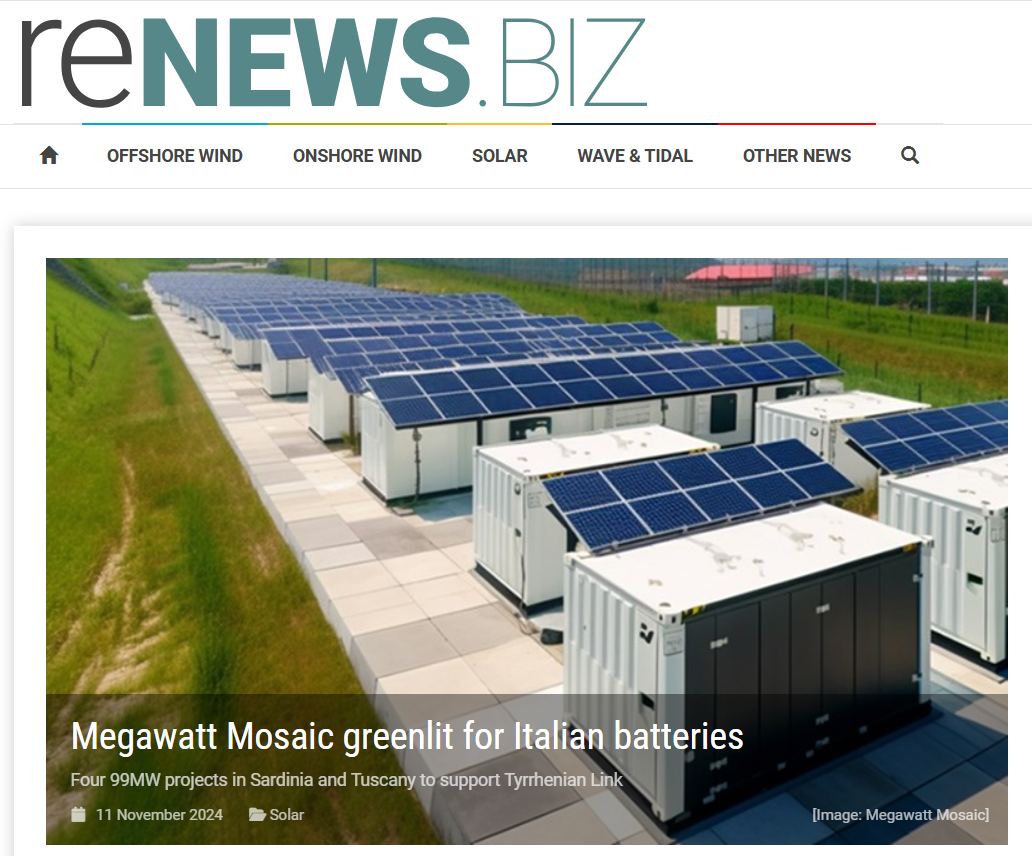

Read MoreDeveloper Megawatt Mosaic has secured planning consent and grid connection for a portfolio of four 99MW BESS sites in Italy – two in Sardinia and two in Tuscany – which will form part of the Tyrrhenian Link, a planned subsea transmission connection. Read the news here

Read MoreMegawatt Mosaic, the BESS project developer, has secured planning consent and grid connection for a portfolio of four 99MW BESS sites in Italy – two in Sardinia and two in Tuscany – which will form part of the Tyrrhenian Link, a planned subsea transmission connection. Helen Passfield, Director of Asset Management at Megawatt Mosaic, said: “During the past three years Megawatt Mosaic has analysed more than 700 potential connection points across Italy to identify sites that can successfully proceed to construction, and onward to connection and operation. “With land rights, grid connection permission granted by TERNA, and EIA studies completed and passed [...]

Read MoreThe Energy Storage Global Conference 2024 (ESGC), organised in Brussels by EASE – The European Association for Storage of Energy, as a hybrid event, on 15 - 17 October, gathered over 400 energy storage stakeholders and covered energy storage policies, markets, and technologies. Experts from across the energy industry emphasise the importance of energy storage to enhance grid flexibility, support renewable integration, and promote industry decarbonisation. Throughout the conference, speakers emphasised that energy storage is no longer a secondary technology but a central enabler of Europe’s future energy system. Various energy storage technologies were identified as critical for providing flexibility at different time intervals, from [...]

Read More