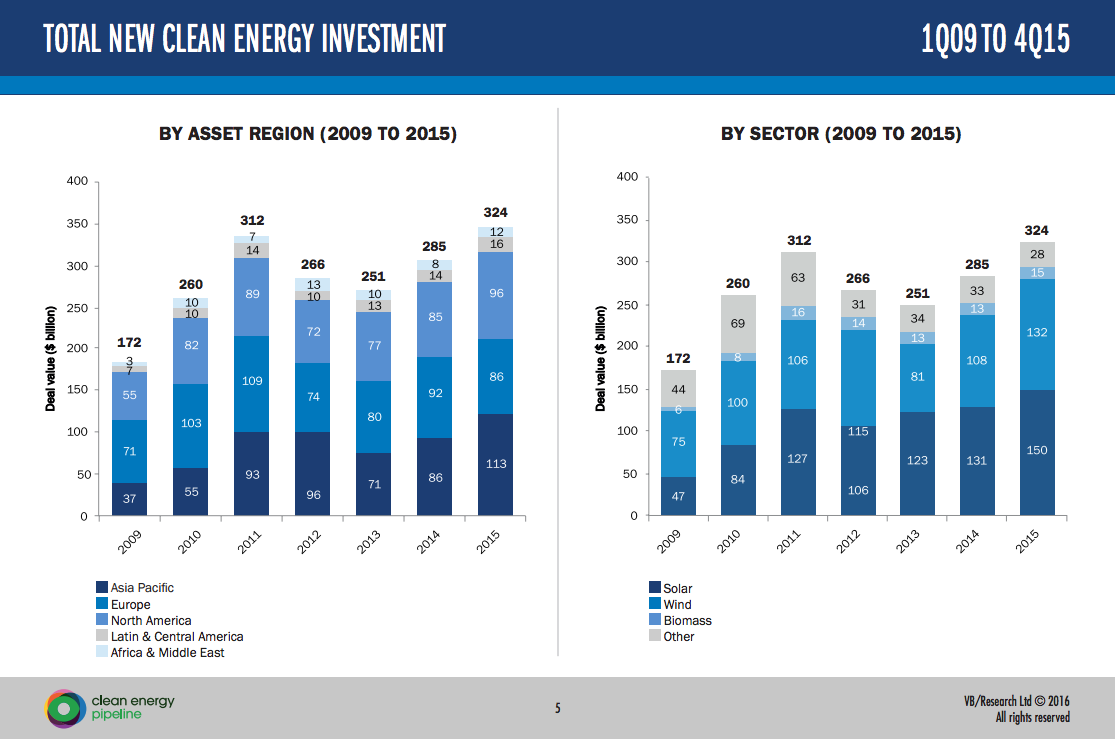

It’s important not to get too cocky about the health of the renewables industry worldwide. Figures released by the Clean Energy Pipeline organisation this week showed that global clean energy investment enjoyed double digit (14%) growth last year over 2015. But before you pop open the low carbon champers and celebrate another bumper year, the figures are a little misleading.

For a start, many of the projects included in the figures have been raising money for years, which means the fact they came to fruition in 2015 makes the numbers look better than they really are. It’s not a sudden flow of capital into the renewable market, so much as the cashing-in of a cheque that’s taken years to write. If these projects had closed sooner, the rise in 2015 investment over the preceding years would have been narrower. It’s easy to mistake this organic growth for the hint of a boom, which it isn’t.

More significant, however, are the circumstances surrounding clean energy investments changed over the same period, and not positively for investors. In the US, concerns over the continuance of tax credits for renewables led to a rush for investors to leverage the tax benefits. The ending of certain classes of subsidy in Europe had a similar effect. In the UK, the industry was positively shocked by the ending of EIS tax breaks for solar and wind, the electricity market was in transition with the ending of the old Renewables Obligation Certificate system and the launch of energy auctions. In the old world, this kind of uncertainty created a rush for projects to be completed under the old rules.

It’s possible that the rise last year was, in part, a panic over the end of the good times for renewable investors. Especially as credit has been cheap for a long time (making it easier to finance projects) and VC and private equity investments in the sector fell again last year. But wait, there’s good news. There is clearly a lot of structural activity in the sector. Over 77GW of projects were refinanced and traded in 2015. And ‘green bonds’ rose 8%, representing around $43.3 billion of investment. In Asia there was a strong rise in project finance (coming from bold moves in China and India to invest and grow their renewable sectors). And, of course, the Paris Agreement has pledged $100bn in climate change mitigation, through multiple agencies and the World Bank to create the stable financial conditions to dramatically boost the private renewables sector in the developing world.

At 350 we were very encouraged by the tone of the news media in two of our key markets, India and Mexico. Last week we saw a lot of coverage of India’s SoftBank, predicting that over the next decade India will become the global hotspot for economic growth, potentially outstripping even China’s legendary growth over the last decade. Of course, given India’s potential for renewable growth (which we’re already involved in) and their financial stability, Softbank’s predictions are very good news for the renewable industry. Similarly in Baja California, where the surging local economy in this area of high natural irradiance (from the sun, not the endless sightings of Hollywood A-listers sunbathing in Los Cabos) is creating the economic conditions for a boom in solar projects… and it’s we’re taking greenfield sites to shovel ready, so we’re set for the boom when it comes.

So 2016 represents a strange prospect for the renewables industry. On the downside, it looks like there might be a few bumps for those sectors of the industry that were driven by subsidies, tax breaks and VC / private equity investment. For the established players, it should be a reasonable year with the trade and consolidation of completed renewable assets, and green bonds too. But the growth in the sector will be driven in new markets, in India, China, Mexico, Chile and the developing economies best placed to leverage the first capital flows through the Paris Agreement, most likely in Asia and South America (Africa might take longer on account of it’s requirement for greater economic stabilisation through UN funding, which might take a few years to really make its presence felt). And given our three main focus areas are India, Mexico and Chile, that means 2016 should be a very good year for 350.