Jack Welch built GE by growing shareholder value steadily, through acquisitions and through stripping anything that scored under 7/10.

At EnviraBoard, they’re taking a page from that playbook.

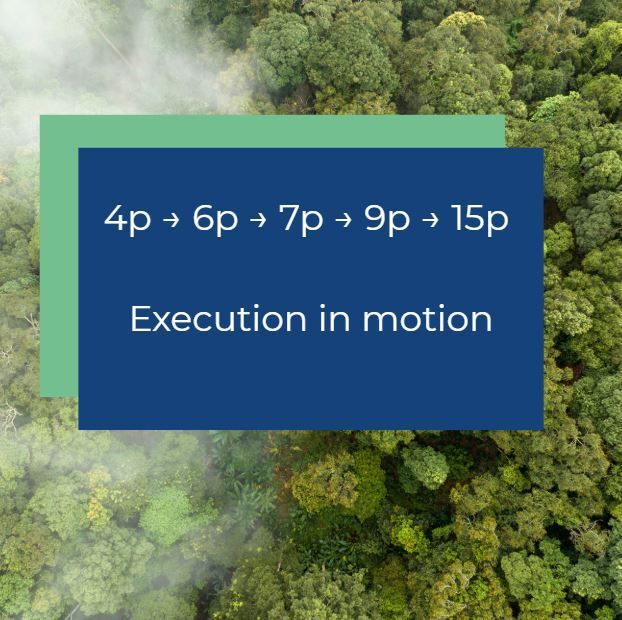

Although they are not planning any acquisitions, EnviraBoard shareprice has moved steadily, in line with real business developments:

• 4p in Q3 2024

• 6p in Q4 2024

• 7p in Q3 2025

• 9p in Q4 2025

We held back the move to 12p in Q4, anticipating that keeping it at 9p would slingshot us into 2026. We were right and so far in 2026, we’ve already banked circa £280k, tracking toward £300k this month – the strongest start we’ve ever had.

As the business moves into its next operational phase, with the miniplant nearing completion and institutional discussions progressing, the next valuation move reflects readiness rather than anticipation.

Accordingly, EnviraBoard will be moving to 15p per share from the 24th of January; our month end.

This isn’t about acceleration.

It’s about alignment between execution, infrastructure, and value.

EnviraBoard is no longer behaving like a startup.

It’s behaving like a business preparing for scale.

For more information on EnviraBoard: https://enviraboard.com/register/