HEADLINES IN ORDER OF FUNDING (EXCEPT WITH SUBSIDUARIES)

Solar 350 & Subsidiary: PAPA ONE LTD:

Weathers Storm Corona Virus Creates. Looks to expand activities in Mexico and LATAM. Watch The latest PAPA One Video here.350 PPM:

Progresses Takeover of Investment Management Company and development of Fintech Base to develop platform and aid to European expansion post Brexit finalisation.Storelectric:

EIS Certificates finally arrive with Storelectric, one year after raise completed. Watch The Latest Storelectric Video here.Waste to Energy Solutions LTD:

Seeks additional sites for development. Liaises with institutional team from 350 PPM in regard to raising own construction funding. Progresses SEIS / EIS Claims. Watch latest WES Video here.Plastic Green Power LTD (previously Power On Demand Services LTD):

Progresses development of its Smart Energy Plants, hires Corporate Finance Advisor.PRICES ARE INDICATIVE ONLY INDIVIDUAL COMPANIES SHOULD BE CONTACTED FOR TRADABLE PRICING INFORMATION PROVIDED FOR INFORMATION ONLY

CONTENTS

Introduction

Company Updates

Solar 350 Ltd (S350) / PAPA ONE Ltd (P1) 350 PPM Ltd (PPM) Storelectric Ltd (STL) Waste to Energy Solutions Ltd (WES) Contact Information Risk WarningsIntroduction – “Cheer Up, It May Never Happen”

For the first time the report below is going to be written by myself in its entirety. Previously, we have had some significant issues with client companies not wishing to release updates every quarter, wishing to delay publication or wishing to distribute their own news to their investors. Omissions are clearly damaging, and some form of update is better than none at all. I appreciate that this is the first update for a while, and we have missed Spring and Summer updates mainly due to Corona Virus concerns, developments, and ramifications. This report is for the benefit of Shareholders of 350 PPM and provides details of the companies we have championed since 2017. This is because in many cases 350 PPM owns / has been awarded shares in these companies. We now provide a facility whereby the companies we have championed, can report to their shareholders via systems completely independently of 350 PPM Ltd. Thus we expect them to be providing their own full reports to you in due course and then quarterly from there. —- Even though we are in one of the best sectors to weather the Corona Virus storm, we have still been affected. Principally, 350 PPM, our co-workers and the companies that we have worked with have been affected by the secondary effects of the Corona Virus: delays and frayed nerves leading to some relatively significant disagreements. The majority of these have been dealt with but it has been a rather unpleasant time. Starting Price: £2.50 per share

Current Price: £18 per share

Solar 350 is working with 350 PPM’s Corporate Finance Team in order to capitalise on further opportunities within the Solar Sector. However, most of the development is occurring in a subsidiary of Solar 350, namely PAPA ONE LTD.

Rather counter-intuitively, renewable energy companies have not done very well over the last 4-5 years since lucrative government subsidies were removed. Many new participants have also entered the market which creates a lower GDP / Entity (Capita) ratio. This is like GDP / Capita but for companies competing in a sector. This is detailed in our report which should be on our Renewable Money Blog now: Listed Environmental Investments

The bet now is twofold:

Starting Price: £2.50 per share

Current Price: £18 per share

Solar 350 is working with 350 PPM’s Corporate Finance Team in order to capitalise on further opportunities within the Solar Sector. However, most of the development is occurring in a subsidiary of Solar 350, namely PAPA ONE LTD.

Rather counter-intuitively, renewable energy companies have not done very well over the last 4-5 years since lucrative government subsidies were removed. Many new participants have also entered the market which creates a lower GDP / Entity (Capita) ratio. This is like GDP / Capita but for companies competing in a sector. This is detailed in our report which should be on our Renewable Money Blog now: Listed Environmental Investments

The bet now is twofold:

- That the commitments of The Paris Agreement force further incentivisation and further innovation reduces costs of generation and brings new technologies to the fore reducing MWh costs further. All or any of this increases profitability of the sector.

- Institutional Investors increasingly insist on investments qualifying for Sustainable Development Goals (https://www.un.org/sustainabledevelopment/) or creating emission reductions or similar – the most profitable of which should be renewable energy.

PAPA ONE LTD (circa 70% of which is owned by Solar 350 Ltd)

Starting Price: £0.20 per share

Current Price: £0.26 per share

Luis and Adam have done exceptionally well to identify and contract to an exceptionally strong partner in Mexico. They bravely turned their back on the initial arrangement they had worked out before their launch. Now they are partnering with a major construction company, which amongst other things, builds mirror manufacturing sites for foreign businesses keen to manufacture in Mexico.

The arrangement is a true partnership with each party investing roughly the same amount and PAPA ONE just edging ownership at 51%. The strategy that 350 has always utilised, of working with strong local partners has again proved invaluable. This is because at present, President Andrés Manuel López Obrador, or AMLO as he is known is attempting to block utility scale renewable energy plants which are due to be developed and owned by foreign Independent Power Producers (IPP’s).

This is a populist measure as historically there has been considerable pride in CENACE and CFE, the national grid and grid regulator. Although in reality, having your energy system dominated and controlled by foreign forces is not the cleverest thing to do, nor is it particularly palatable to the general population.

Because of our respectful structure (a partnership with a Mexican company), PAPA ONE avoids these conflicts and because of these conflicts we expect less generational capacity to come online, which in turn will lead to higher electricity prices, which of course benefits us.

Obviously there have been delays due to Covid, but the necessary funds are ringfenced so there should be no cash call. Adam and Luis and their partners have also amassed a number of utility scale projects close to shovel ready / ready to build and are now engaging with 350 PPM’s Corporate Team. I am hoping at some point soon we get the first 100 MW financed and ready to build and then after that things get a lot easier. They are still keen to target a GW of development in Mexico and other opportunities in LATAM.

For information please contact: https://www.papa-one.com/contact-us

PAPA ONE LTD (circa 70% of which is owned by Solar 350 Ltd)

Starting Price: £0.20 per share

Current Price: £0.26 per share

Luis and Adam have done exceptionally well to identify and contract to an exceptionally strong partner in Mexico. They bravely turned their back on the initial arrangement they had worked out before their launch. Now they are partnering with a major construction company, which amongst other things, builds mirror manufacturing sites for foreign businesses keen to manufacture in Mexico.

The arrangement is a true partnership with each party investing roughly the same amount and PAPA ONE just edging ownership at 51%. The strategy that 350 has always utilised, of working with strong local partners has again proved invaluable. This is because at present, President Andrés Manuel López Obrador, or AMLO as he is known is attempting to block utility scale renewable energy plants which are due to be developed and owned by foreign Independent Power Producers (IPP’s).

This is a populist measure as historically there has been considerable pride in CENACE and CFE, the national grid and grid regulator. Although in reality, having your energy system dominated and controlled by foreign forces is not the cleverest thing to do, nor is it particularly palatable to the general population.

Because of our respectful structure (a partnership with a Mexican company), PAPA ONE avoids these conflicts and because of these conflicts we expect less generational capacity to come online, which in turn will lead to higher electricity prices, which of course benefits us.

Obviously there have been delays due to Covid, but the necessary funds are ringfenced so there should be no cash call. Adam and Luis and their partners have also amassed a number of utility scale projects close to shovel ready / ready to build and are now engaging with 350 PPM’s Corporate Team. I am hoping at some point soon we get the first 100 MW financed and ready to build and then after that things get a lot easier. They are still keen to target a GW of development in Mexico and other opportunities in LATAM.

For information please contact: https://www.papa-one.com/contact-us

350PPM LTD

Starting Price: £0.125 per share (post-split)

Current Price: £4.20 per share (post-split)

Principally, the way I have chosen to manage 350 PPM is as follows: operate on introducer fees, expand on equity and profit on shares.

To expand on this further, and it can’t be exact, we operate on the cash the business develops; offices, research, due diligence, wages, contractors, IT etc; we utilise equity sales to raise additional cash to expand the business; and we record profits from the acquisition of equity in companies we have championed, invested in or introduced to.

Regardless, with a strategy of aligning our objectives with the companies we work with and the investors that invest in those companies, it is fairly important that we build out our capabilities to provide the finance they require.

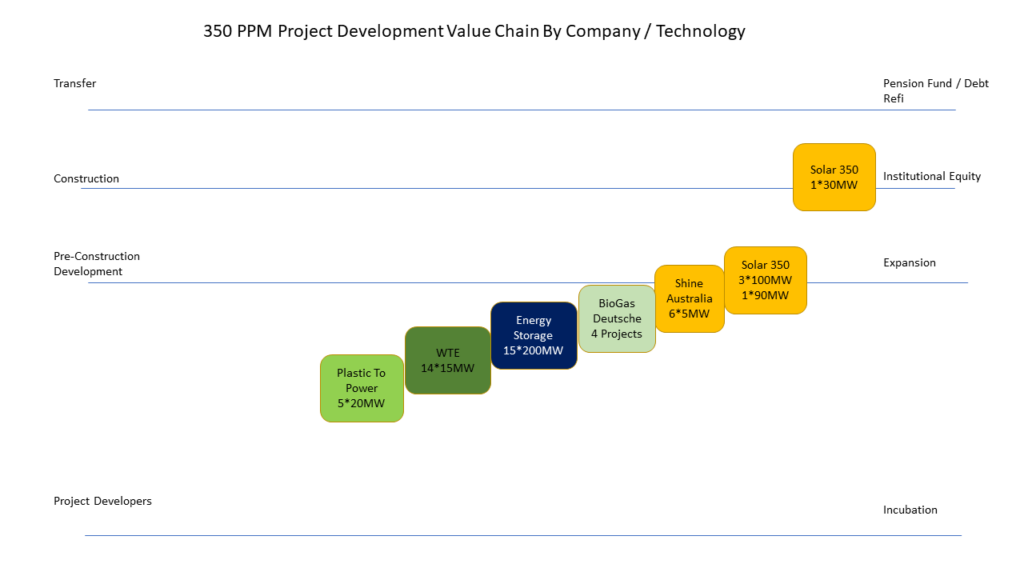

The steps that we have established are as follows:

Starting Price: £0.125 per share (post-split)

Current Price: £4.20 per share (post-split)

Principally, the way I have chosen to manage 350 PPM is as follows: operate on introducer fees, expand on equity and profit on shares.

To expand on this further, and it can’t be exact, we operate on the cash the business develops; offices, research, due diligence, wages, contractors, IT etc; we utilise equity sales to raise additional cash to expand the business; and we record profits from the acquisition of equity in companies we have championed, invested in or introduced to.

Regardless, with a strategy of aligning our objectives with the companies we work with and the investors that invest in those companies, it is fairly important that we build out our capabilities to provide the finance they require.

The steps that we have established are as follows:

- Technology: any environmental innovation will need considerable funding.

- Incubation: any company seeking to exploit the commercial potential of any environmental technology (not just ones we have financed) will need some early financing, to identify environmental projects.

- Pre-Construction Development: once a series of suitable projects have been identified, the project developer will need funding to develop the projects from green/brownfield through to ready to build / shovel ready / oven ready.

- Construction: based on the projects reaching ready to build, construction equity and debt is now needed to build out the project. Of course, the other option is for the project developer to sell the Ready to Build project.

- Asset Management / YieldCo: once the project is operational it should produce a relatively stable cashflow for at least 25 years, accordingly, we either need to have funds ready to buy the operational asset or access to pension and infrastructure funds that can purchase the performing asset.

Latest Developments

Having directed our focus on Pre-Construction Development and having achieved the market / product fit that Silicon Valley Investors deem so important (basically that our offerings are attractive to investors), we are now looking to scale our operations and by next year, we should have a regulated fintech base established and have taken over an asset management company in the UK. Although things are slow at present.

For further information please register on the website here: www.350ppm.co.uk

Latest Developments

Having directed our focus on Pre-Construction Development and having achieved the market / product fit that Silicon Valley Investors deem so important (basically that our offerings are attractive to investors), we are now looking to scale our operations and by next year, we should have a regulated fintech base established and have taken over an asset management company in the UK. Although things are slow at present.

For further information please register on the website here: www.350ppm.co.uk

STORELECTRIC LTD

Starting Price: £0.25 per share (post 1:100 share split)

Current Price: £1.50 per share (post 1:100 share split; latest model price £1.53)

We estimate that for every 10 GW of wind power, you need 3 GW of storage. This is absolutely impossible utilising current battery technology or any other technology that we are aware of.

Storelectric’s simple solution to what is the holy grail of renewables is a complete gamechanger and one of the reason’s 350 PPM got into this business in the first place. The challenge is to now construct the first site.

The reassuring factor in all of this is that all the engineering groups Storelectric are working with agree that they have the solution. In reality, I can see 350 PPM raising the required finance for Storelectric, but we need the UK GOVT to come forward with some utility scale energy storage subsidies first. This is likely, because although they keep barking on about not using coal during May because it was sunny and windy, they fail to mention that there was little industry occurring due to Covid 19.

In short, to avoid blackouts or a working week when the wind dictates when the machines and cars can run, we need cheap utility scale storage that is relatively emission free to set up and take down (unlike batteries).

Storelectric’s EIS Certificates are on their way to investors. For further information or to contact: https://www.storelectric.com/

Starting Price: £0.25 per share (post 1:100 share split)

Current Price: £1.50 per share (post 1:100 share split; latest model price £1.53)

We estimate that for every 10 GW of wind power, you need 3 GW of storage. This is absolutely impossible utilising current battery technology or any other technology that we are aware of.

Storelectric’s simple solution to what is the holy grail of renewables is a complete gamechanger and one of the reason’s 350 PPM got into this business in the first place. The challenge is to now construct the first site.

The reassuring factor in all of this is that all the engineering groups Storelectric are working with agree that they have the solution. In reality, I can see 350 PPM raising the required finance for Storelectric, but we need the UK GOVT to come forward with some utility scale energy storage subsidies first. This is likely, because although they keep barking on about not using coal during May because it was sunny and windy, they fail to mention that there was little industry occurring due to Covid 19.

In short, to avoid blackouts or a working week when the wind dictates when the machines and cars can run, we need cheap utility scale storage that is relatively emission free to set up and take down (unlike batteries).

Storelectric’s EIS Certificates are on their way to investors. For further information or to contact: https://www.storelectric.com/

WASTE TO ENERGY SOLUTIONS LTD

Starting Price: £0.08 per share

Current Price: £0.25 per share

WES has a great strategy of developing and in time constructing medium scale Waste to Energy Plants around the country.

Large waste processing facilities tend to fall victim to planning / not in my back yard (NIMBY) planning restrictions. Yet Council’s or district waste processing facilities tend to avoid this as people acknowledge their waste should be disposed of / handled locally. Effectively it is a necessary evil.

On top of this WES’s plants can produce heat (vital for manufacturing, industry, and district heating) as well as electricity, so all in all it’s a winning formula. For those wishing to claim SEIS / EIS, there has been a delay, but WES is now pursuing this through their new accountants.

For further information or to contact please visit: www.wastetoenergysolutions.co.uk

PLASTIC GREEN POWER LTD

Starting Price: £0.08 per share

Current Price: £0.25 per share

WES has a great strategy of developing and in time constructing medium scale Waste to Energy Plants around the country.

Large waste processing facilities tend to fall victim to planning / not in my back yard (NIMBY) planning restrictions. Yet Council’s or district waste processing facilities tend to avoid this as people acknowledge their waste should be disposed of / handled locally. Effectively it is a necessary evil.

On top of this WES’s plants can produce heat (vital for manufacturing, industry, and district heating) as well as electricity, so all in all it’s a winning formula. For those wishing to claim SEIS / EIS, there has been a delay, but WES is now pursuing this through their new accountants.

For further information or to contact please visit: www.wastetoenergysolutions.co.uk

PLASTIC GREEN POWER LTD

Starting Price: £0.08 per share

Current Price: £0.29 per share

PGP have been insistent on re-negotiating our agreement with them. They claim that the Share Claw Call Option Clause (Syco clause), is deterring other groups from investing and also will affect their ability to claim SEIS /EIS reliefs on behalf of investors.

Accordingly, the new agreement does not include this clause and our ability to access the SCCO clause has ceased. To send them on their way and to provide a bonus for all investors, 350 PPM has transferred 250,000 of its shares to Mark Christensen, who is a new addition to the team and partner to Sean Lindgren. Sean has also transferred Mark, 10% of his holding.

Thus, this anti-dilutionary event, which preserves existing investors a 20% dilution, which they would normally have experienced should make up for the beneficial effects of the SCCO Clause, if it was ever to be needed.

For further information or to contact: https://plasticgreenpowerltd.co.uk/

Starting Price: £0.08 per share

Current Price: £0.29 per share

PGP have been insistent on re-negotiating our agreement with them. They claim that the Share Claw Call Option Clause (Syco clause), is deterring other groups from investing and also will affect their ability to claim SEIS /EIS reliefs on behalf of investors.

Accordingly, the new agreement does not include this clause and our ability to access the SCCO clause has ceased. To send them on their way and to provide a bonus for all investors, 350 PPM has transferred 250,000 of its shares to Mark Christensen, who is a new addition to the team and partner to Sean Lindgren. Sean has also transferred Mark, 10% of his holding.

Thus, this anti-dilutionary event, which preserves existing investors a 20% dilution, which they would normally have experienced should make up for the beneficial effects of the SCCO Clause, if it was ever to be needed.

For further information or to contact: https://plasticgreenpowerltd.co.uk/

CONTACT INFORMATION

Tel: +44 (0) 203 151 1 350 Email: info@350ppm.co.uk To contact us by email, use the contact us page.RISK WARNINGS

The information contained herein is prepared for general circulation and is intended to provide information only. It is not intended to be constructed as a solicitation for the sale of any particular investment nor as investment advice and does not have regard to the specific investment objectives, financial situation, and particular needs of any person to whom it is presented. The information contained herein is not to be relied upon as a basis of any contract or commitment and is believed to be correct but cannot be guaranteed and 350 PPM cannot be held liable for any inaccuracies or omissions. Any opinions expressed in the report are those of the individual and not necessarily those of 350 PPM. If in the course of reading 350 PPM’s (and its subsidiaries and sub brands) research, analysis and comment, individuals identify investment themes or opportunities, and contact the underlying companies or product providers in regard to potential investment, before proceeding they should seek independent advice in regard to the suitability of those investments, in light of their own circumstances. Investors should understand that the decision to proceed, having taken appropriate advice or not, is their own, and 350 PPM will accept no liability for the actions of the individual. 350 PPM (and its subsidiaries and sub brands) do not and will not provide any financial advice. Our Sector Research, Trading Updates, Industry Comment and other associated comment and documents are provided for information only and any action individuals take as a result of information provided, is of their own volition and responsibility. Individuals should remember that should they decide to invest in the environmental sector, 100% of their capital could be at risk and tax treatment may vary. Please consider carefully all risks and taxation factors before investing. In particular, the information contained on this email is not intended for distribution to, or use by, any person or entity in the United Stated of America (being residents of the United States of America or partnerships or corporations organised under the laws of the United States of America or any state of territory thereof) or any other jurisdiction or country where such distribution or use would be contrary to law or regulations or which would subject 350 PPM (and its subsidiaries and sub brands) to any requirement to be registered or authorised within such jurisdiction or country. Should an individual invest in the environmental sector, he / she should be aware of the following: The value of his/her investment(s) and the income from them can fall as well as rise. An investor may not get back the amount of money invested. Past performance and forecasts are not reliable indicators of future results. Foreign currency denominated investments are subject to fluctuations in exchange rates that could have a positive or adverse effect on the value of, and income from, the investment. Investors should consult their professional advisers on the possible tax and other consequences of holding such investments. No representation or warranty is given as to the availability of EIS or any other form of investment tax relief. Since the requirements to fall within the EIS scheme must be monitored at all times, it is possible that if the requirements are met today, they might not be tomorrow. Even if the respective companies management believe the company qualifies today and will use all reasonable endeavours to ensure the company qualifies in the future for EIS or other tax relief, qualification can never be guaranteed and thus investors should be aware that their tax treatment may vary. The information contained herein is not intended to be passed to third parties without 350 PPM’s prior content and may not be reproduced in whole or in part, without the permission of 350 PPM. 350 PPM Ltd is registered in England under company number 07647973.

Categories :

Updates