Winter Investor Update 2018 main author: Nicholas Dimmock BA MBA(CASS), Director of Investor Relations, 350 PPM Ltd. Economic commentary by the 350 PPM research team.

_____________________

Headlines in Order of Funding

Solar 350: continues to market 420 MW Mexican solar pipeline – tense times but looking positive.

350 PPM: considers listing options as investment business scales and business model refines.

Disarmco: now producing regular income, £6M in UN Bids outstanding.

Storelectric: signs agreement with NAM, the largest energy company in the Netherlands.

Waste to Energy Solutions: acquiring competitor and takes 12.5% stake in gas peaker business.

.

_____________________

Contents

Company Updates:

.

_____________________

About 350 PPM

350 PPM Ltd is an environmental incubator and business accelerator specialising in green investment opportunities often categorised as “ESG” Investments.

350 PPM Ltd directly identifies Companies, Projects and Technologies that it believes will benefit substantially from the implementation of The Paris Agreement; the new global treaty to combat climate change which has now been ratified and comes into force on 1st January 2020.

350 PPM then structures these opportunities under the UK’s Enterprise Investment Scheme (EIS) where possible and works with, advises, assists and raises finance for such businesses along the commercialisation runway, to ensure they reach their full potential.

The commercialisation runway is defined within 350 as 4 stages: Incubation, Expansion, Venture Capital, and Listing. 350 PPM always invests in the companies it champions and builds meaningful stakes in such businesses.

By working closely with the client company at every stage and assisting in its growth where possible, 350 PPM can protect its and its investor’s interests, influence the outcome and potentially share in the client company’s and its investment client’s success both now and in the future.

All companies that 350 PPM champions are designed to profit extensively from the implementation of The Paris Agreement. The Paris Agreement is expected is result in a 90 Trillion Environmental Revolution, which is expected to boost economic growth significantly:

https://newclimateeconomy.report/2016/

https://newclimateeconomy.net/content/commentary-90-trillion-question

Sir Nicholas Stern estimates that not combating climate change will lead to losses in global GDP of between 5 and 20% based on several factors the most significant of which are breakdowns in supply chains, global unrest through loss of agricultural capabilities, fresh water supply issues, loss of land mass and housing.

Summary and Link to Actual “Stern” Report can be found here: https://en.wikipedia.org/wiki/Stern_Review.

.

_____________________

Economic Commentary

Brexit

If you are groaning at the mere sight of the word Brexit, I’m right with you and apologies. In our defense, we haven’t covered this issue before and we thought we should, if only briefly, and with a skew towards the potential effects of a no-deal Brexit on energy, climate and waste. The effects of Brexit on the economy in general have been covered to death elsewhere (for example, see https://www.bbc.co.uk/news/business-47168866).

Clearly, Brexit uncertainty has not been a good thing, but the economy has arguably held up much better than many expected. When the uncertainty clears, there is the hope of a “deal dividend” – businesses and consumers going ahead with the spending that they may have been holding back.

As we describe next, there are potentially some positive aspects even to a no-deal Brexit for 350 PPM client companies.

————

No-deal Brexit: Energy, Climate and Waste

The government laid out in its recent energy and climate guidance the things that will and will not change in the event of a no-deal Brexit.

Things not changing include:

- The government’s Industrial Strategy.

- The Climate Change Act.

- Cross-border trade for gas.

- All requirements under both the Feed-in Tariffs Scheme and Contracts for Difference schemes and the Renewables Obligation.

- Regulations for the monitoring, reporting and verification of greenhouse gases.

However, following on from the last point, the rules governing the EU ETS (Emissions Trading System) would no longer apply to the UK in the event of a no-deal Brexit. This means that UK businesses would no longer need to buy and surrender allowances (EUAs) for emissions they create.

Instead, a new UK Carbon Emissions tax would be introduced on the 1st of April. This tax would initially be set at £16 per tonne of greenhouse gas emitted over and above an installation’s emissions allowance (which would be based on the installation’s free allowance allocation under the EU ETS). Prices for the following years would be set in the budget.

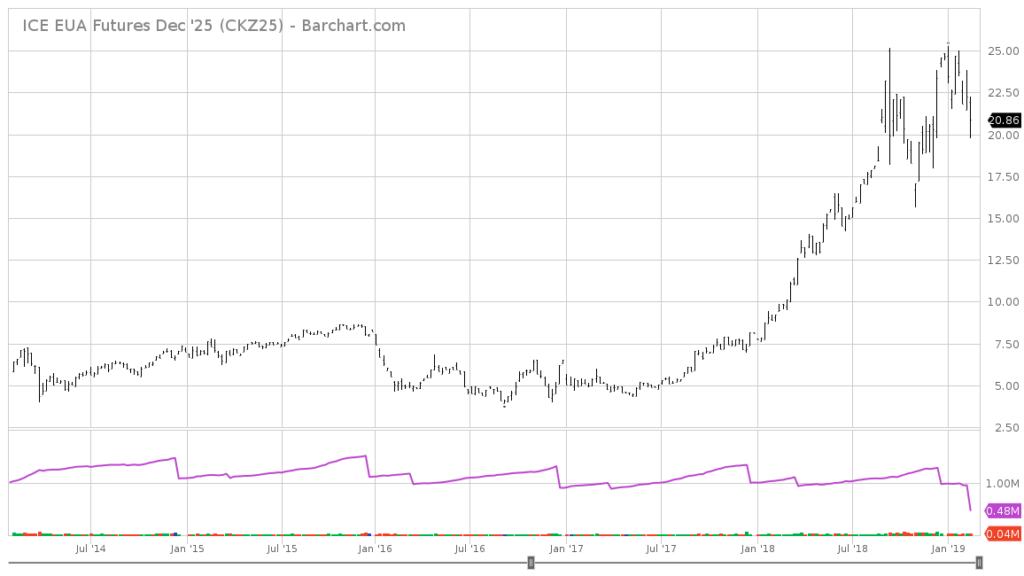

The fixed price of £16 per tonne is not dissimilar to the current free-floating price of EUAs – please see the graph below (dominated in euros) – meaning that the total carbon price paid by the UK power sector, including the Carbon Price Support, would remain roughly the same – £34/tCO2e. This is arguably high enough to prevent the resurgence of coal and support the development of new low-carbon power projects.

Long-term, it is not known if the UK Carbon Emissions tax would remain, or if some other system, such as a UK emissions trading scheme, would take over.

For more background and detail, see http://www.lse.ac.uk/GranthamInstitute/news/what-does-the-october-2018-budget-mean-for-uk-carbon-pricing-in-a-no-deal-brexit/.

The other major consequence of a no-deal Brexit would be the removal of the UK’s electricity markets from the EU internal energy market. This would mean that alternative trading arrangements would need to be developed for the purchase and sale of power cross-border via interconnectors.

The government states that they have ‘worked with Ofgem and the National Grid to ensure existing measures are in place to deliver continuity of supply for Great Britain…but trade via interconnectors will be less efficient’.

Northern Ireland is potentially more problematic than Great Britain; for example, in the unlikely event that the Single Electricity Market (SEM) with the Republic of Ireland is unable to continue.

Beyond the potential for short-term disruption, there is also the longer-term issue of the current electricity price imbalance between the UK and Europe. This has the potential to lead to tariffs on EU to UK electricity flows.

The net result of the above issues, as well as the potential impact of Brexit on the Pound – Euro exchange rate, may be that electricity from Europe becomes more expensive. This would in turn put up local electricity prices. This would be a positive for UK generators, with a special mention going to gas peaker plants (relevant to Waste to Energy Solutions, one of our incubated companies). Reduced demand for interconnector capacity would also be positive for other forms of flexibility, such as energy storage.

For more background and detail on Brexit and interconnectors, see https://www.fieldfisher.com/media/5313890/interconnectors-brexit.pdf.

Finally, it is worth mentioning that Brexit may have an additional positive impact on Waste to Energy Solutions (and all local waste processors). This is because Brexit raises the possibility that exporting RDF (Refuse Derived Fuel) will become less economic. While it looks likely that tariffs will not apply to RDF, other factors such as border controls and delays, and haulage costs, could adversely affect the economics of RDF export. If not being exported, this waste will have to be dealt with locally, increasing the demand for local Waste to Energy capacity.

In summary, Brexit is unquestionably both confusing and tedious, but it may not be bad for absolutely everyone.

————

COP24 UN Climate Conference

The latest annual UN climate conference took place in Katowice, Poland back in December 2018.

The main aim was to agree a Paris Agreement ‘rulebook’, which formalises how the agreement will operate when it comes into force in 2020. The rulebook covers a multitude of questions, such as how countries should report their greenhouse gas emissions or contributions to climate finance, as well as what rules should apply to voluntary market mechanisms, such as carbon trading.

Despite a predictably antagonistic stance from the likes of the US and Brazil, talks did not collapse. Although agreement was not reached on all issues – such as the rules for voluntary market mechanisms, which have been pushed back to COP 25 – consensus was found on the majority. The rulebook even leaves open the possibility that a post-Trump US (what a happy thought) could re-enter the Agreement.

With the rulebook largely in place, this heralds the start of a new international climate regime under which all countries will have to report their emissions – and progress in cutting them – every two years from 2024.

Whilst the technical detail of the talks (see https://www.carbonbrief.org/cop24-key-outcomes-agreed-at-the-un-climate-talks-in-katowice ) will have passed most people by, COP 24 is most likely to be remembered by the general public for speeches given by Sir David Attenborough and by the 15-year-old Swedish activist Greta Thunberg.

During his speech, David Attenborough declared that “if we don’t take action, the collapse of our civilisations and the extinction of much of the natural world is on the horizon”.

Meanwhile, Greta Thunberg got stuck into a room of adults and fanned the flames of the growing youth climate movement:

“You say you love your children above all else, and yet you are stealing their future in front of their very eyes. Until you start focusing on what needs to be done rather than what is politically possible there is no hope. We cannot solve a crisis without treating it as a crisis… If solutions within this system are so impossible to find, then maybe we should change the system itself.”

Watch her full speech below:

For more positives from COP 24, see https://www.businessgreen.com/bg/blog-post/3068348/the-positive-signal-from-cop24-is-clear-and-businesses-are-responding.

Now onto the company reports… .

.

_____________________

Solar 350 Ltd

Starting Price: £2.50 per share

Current Price: £30 per share

———-

We are still marketing our consortium of Mexican projects to various VCs, family offices and infrastructure funds. We feel we are close to numerous bids and work continues to acquire debt and fixed Price Power Purchase agreements for the 1st and then subsequent projects.

The 420 MW is made up of 5 projects in various stages of development with the first 30 MW very close to “ready to build”.

In total, very loosely, the 420 MW requires $350 M of debt, which we have indicative offers on from two Mexican Banks, and $150 M of equity. We are looking for a framework deal whereby the same project buyer / equity provider commits to finance each project under the same terms. This way we can just get on with developing and, of course, build the relationship. 350 has been very successful under these structures before, leading to circa 30 projects under the Kyoto Protocol.

——–

We have also had a bit of luck in Mexico, in that the new President has cancelled the National Energy Reverse Auctions. This has forced prices up and now corporates and industrials that had been banking on cheap power are now willing to sign direct Power Purchase Agreements.

The standard argument in favour of lower prices is this: if you add more renewable energy to an existing grid, more power for the same demand means a lowering of prices. The flaw in the logic is however Mexico’s commitment to reduce its emissions under The Paris Agreement, and to a certain extent, very significant increases in demand by consumers and industrials as Mexico industrialises and transitions towards a developed economy.

Mexico’s INDC (Intended Nationally Determined Contribution) can be found here: https://www4.unfccc.int/sites/submissions/indc/Submission%20Pages/submissions.aspx

Committing to this will involve taking a significant proportion of Mexico’s fossil fuel generation offline.

To give you an example of what is happening in the Mexican Electricity Market, power prices at the injection node on the first 30 MW Project have been increasing at circa 55% per year over the last three years and now stand at an average of circa 95 USD/MWh.

This has opened up the Mexican market to more “mid tier” foreign direct investment and as the corporates and industrials are mostly exporters, they are willing to commit to Power Purchase Agreements denominated in US Dollars.

This in turn has reduced the costs of capital of the projects as the projects can now borrow in USD at circa 5.5% as opposed to circa 11.2% in Mexican Pesos, which of course significantly boosts the development potential of the sites.

The second bit of luck that we have had is that as the path to solar commercialisation becomes more predictable (effectively what you’re left with in regard to well developed projects is Construction and Operational Risk), the value of the sites has increased and thus the amount developers can achieve. Our current offer is $150,000 per MW with 20% equity carry into the project. While project buyers / equity funders are interested in achieving the best terms, compared with the importance of finding a reliable, investment grade offtaker, and the value creation as the asset becomes operational, the development fee is relatively insignificant.

————

Solar 350 has also really found its position in the market as an entity which can facilitate debt, Power Purchase Agreements and equity to projects that are close to ready to build. This is a very defensible position and similar to that which Carbon 350 adopted during the Kyoto Protocol.

Its still early days for The Paris Agreement, with circa 250 Billion USD being invested in renewable energy worldwide. Our estimates are that on average this figure will run at circa 1.25 trillion per year for the period 2020 to 2050.

Which means subject to us getting the first project (30MW) away, we have a very bright future. No pun intended.

—

____________

350 PPM LTD

Starting Price: £12.50 per share

Current Price: £170 per share

———-

PPM has further refined its business model and found what I would consider a rather sweet spot in the environmental investment market.

This is as an Environmental Incubator and Business Accelerator specialising in environmental opportunities.

As opposed to Crowdfunding, that will promote any investment opportunity as long as the raising entity can reach 75% of its investment target via internal means, which is then routed through the platform, 350 PPM now identifies successful project developers and reverses them into a new company, which we will then structure under EIS (if possible).

350 PPM subsequently handles a fair amount of the administration of the business, allowing the company to get on with running their business.

In addition, as normal, we will introduce them to our network of high net worth and sophisticated investors, and at a later date introduce them to VCs, family offices and infrastructure funds, known to us, that will hopefully wish to finance their projects (effectively the same process that is happening with Solar 350 now).

We didn’t use the Environmental Incubator structure for Solar 350, Disarmco or Storelectric, as these were established businesses, but have done for Waste to Energy Solutions and shortly, Power on Demand Services Ltd (PODS). You can find our Sector Research Notes on all the companies here: https://350ppm.co.uk/renewable-money-blog/.

However, because we have handpicked these teams, this should give us a significantly higher success rate than the crowdfunders, which continue to experience rather horrendous results: http://fantasyequitycrowdfunding.blogspot.com/

We don’t get the volume of new subscribers generated by hundreds of companies trying to fund themselves such as the crowdfunders do, and in this regard, their business model is very strong. However, the collateral damage of achieving these subscriber numbers has been significant both in terms of the costs of funding their own business and investors losses on funded businesses: http://fantasyequitycrowdfunding.blogspot.com/2019/02/we-take-look-at-crowdcubes-early-2018.html

——–

Of late our marketing initiatives are starting to gain traction, as the awareness of the impacts of The Paris Agreement hit home. This is encouraging as for a long time, it felt like we were being crowded out by the crowdfunding craze.

Also, because we take significant equity stakes in the companies we champion, our margins (as long as the companies are successful) are significantly higher than the crowdfunders.

Recently, we have introduced 3 more investor relations consultants onto our team, and we are speaking to 4 more, so we have very significant buy in from investment industry professionals.

350 PPM made £145,818 to November 2017 and while the year to November 2018 will be disappointing, as we effectively had to restructure and then restart the business, the year to November 2019 should be exceptional.

As you might remember, early on in the technology boom, people began to list Technology Incubators. These became some of the most popular new issues of their time. As such, with three years of profitable trading behind us, it is our plan to start investigating listing opportunities for 350 PPM Ltd.

This could also pave the way for our client companies to either be absorbed into the listed entity (350 PPM), or list through the same means, counterparties and processes. This would then of course provide an exit for investors.

Ultimately, there are generalists and there are specialists. But I cannot see that in a brutally competitive business environment, generalists can achieve the depth of knowledge and tacit understanding of how every thing really works across numerous sectors to deliver shareholder value. The same is true for 350 PPM versus our generalist competitors.

350 and its employees, consultants and investors have made a very significant bet on the environmental sector, which has been based solely on logic, but with a 90 Trillion USD Environmental Revolution potentially around the corner, would you really rather be anywhere else ?

———-

New Clients

350 PPM is always looking for new clients. If you have suitable friends, colleagues or rich and powerful enemies, please don’t hesitate to provide them with our details. They can register themselves here: https://350ppm.co.uk/investments/.

I am afraid we can’t reward you financially, however, we can offer you a 350 PPM Environmental All Star T-Shirt, which you would rightly deserve. There will also be a pink one for people who like pink.

.

Disarmco Holdings Ltd

Starting Price: £5.51 per share

———-

JANUARY 2019 UPDATE

During the three months since the last update, our focus has continued to be on the development of the prototype Transportable Ammunition Disposal Facility (TADF) and the commercialisation of our range of Thermal Products & Pyrotechnics.

TADF

We have developed solutions to a number of significant design features, with a particular focus on safety, including (i) calculation of all operational “Safe Distances” and the maximum safe daily stockpile of ammunition at the facility; (ii) ensuring HE (High Explosive) is properly segregated following extraction and cannot be accidentally shed from projectiles during transportation; (iii) re- orientation of the cutting/extraction tool; and (iv) selection of a UK vendor for blast/flash protection equipment).

We have submitted another patent application for a specific tool used within the cutting and extraction process.

We have now definitively established the conveyor layout and fully scoped out the required engineering work around this, as well as the design of the “load to line” of the projectiles.

We are pleased to confirm that Martin Underwood has joined the Company. Martin is an ex British Army, Ammunition Technical Officer, with experience in Explosive Safety, Security and Defence. He is a Principal Counter-IED Technical Advisor to NATO.

The number of staff required both in-country and for Disarmco’s own dedicated team have been reviewed and confirmed in terms of numbers required, and an in-country training supplier identified. Export licences for the system are under review.

Supplier tests were successfully performed in December 2018, with live field testing of the system at suitably licensed premises to be booked for April 2019.

Discussions with both the Indian MoD and the UN Development Programme (regarding Libya) regarding TADF deployments beginning in 2019 remain on track.

Thermal Products & Pyrotechnics

UN bids totalling £6m. Latest update from UN – for logistical reasons, UN has decided to reconfigure the target areas from 5 locations to 2 locations. This is currently with the review Board.

Repeat order from Bangladesh MoD will be forthcoming in January 2019 – 2500 units – £75,000.00

Hong Kong Police Force – successful delivery completed in November 2018 – £7,900.00 – feedback received as follows: “Just to let you know the order passed acceptance testing – very well. We will be placing another order next year 2019”.

G4S – initial order delivered – 96 torches – €8,000.00

Rivolier (affiliated to French MoD) – successful delivery of 24 units for demonstration at French test site. Awaiting further updates on future orders. .

Storelectric Ltd

Starting Price: £0.25 per share (post 1:100 share split)

Current Price: £1.15 per share (post 1:100 share split; latest model price £1.53)

———-

Please note that on 18/12/2018, a Storelectric share split took place. This had no effect at all on the valuation of Storelectric as a whole or individual shareholdings in Storelectric. For each 1 share that an existing shareholder used to own, the shareholder now holds 100 shares, at a price that is 1/100th of the pre-split price. To repeat, there is zero overall effect for existing shareholders. The split was performed so that new shareholders could buy at £1.15 per share and not £115. This is a more practical and psychologically comfortable value.

———-

Fundraising

Storelectric’s current fundraising round with 350 PPM has proved extremely popular to date and remains open, for the time being, for those interested in investing. As stated previously, there is a funding limit, and this may be the last opportunity for retail investors to get involved in the near-term.

For those new to Storelectric, the six-word pitch is ‘enabling renewables to power the world’. This is achieved by storing renewable energy on a large-scale using Compressed Air Energy Storage (CAES). CAES works by using electricity to compress air, then expanding this air through a turbine when needed. Storelectric is now working with NAM, the largest energy company in the Netherlands, jointly owned by Shell and Exxon. There is a video introduction to Storelectric available.

For further information, new 350 PPM investors can register at https://350ppm.co.uk/investments/. Existing clients can contact us.

————

News

Below we give a summary of Storelectric-related developments over the past 3 months. The best and most frequent source of news is Storelectric’s own website and newsletter – you can sign up at www.storelectric.com (scroll down to the bottom).

NAM

Following Storelectric’s victory in the NAM Challenge last year, NAM has entered into a non-disclosure agreement with Storelectric to take their work together to the next level. Quoting NAM:

“NAM is interested in the transition from fossil to renewable energy in the Netherlands and to that end initiated the NAM70 Challenge to explore the best grid-scale technologies available today. Storelectric won the competition with a unanimous vote from a 5-member jury panel consisting of key stakeholders in the energy sector namely NAM, Royal Haskoning DHV, VEMW & New Energy Coalition, Ecorys, Delft University of Technology.

As a follow up on NAM 70 Challenge, NAM and Storelectric are exploring the potential of the opportunity to develop, construct and/or operate one or more CAES plants through a feasibility study (the “Project”).

For this purpose, Parties are interested in undertaking discussions in relation to the Project.

In relation to and in order to facilitate such discussions, the Parties have entered into an Agreement to enable them to share information and work together.”

It is expected that NAM will employ Storelectric to conduct feasibility studies covering both types of CAES (Thermal Energy Storage (TES) and Combined Cycle Gas Turbine (CCGT)), across a range of sizes. Work beyond this stage will be detailed in a further written agreement.

Project of Common Interest (PCI)

No formal decision has yet been reached on Storelectric’s bid for EU PCI funding, potentially opening up a grant of 50% for an initial study for the 40MW and 500MW Cheshire projects. Clarifications are pending and a meeting in Brussels is being scheduled.

Storelectric’s association with NAM has created the possibility of Storelectric being involved in a separate PCI project in the Netherlands. Initial discussions with the partners were held in Amsterdam in January 2019. One of the partners has expressed an interest to work with Storelectric on its UK projects.

UK Projects

In Cheshire, the pre-planning application for the 40 MW plant has been submitted. A joint meeting with Cheshire West council, the landowner, and ERM (planning specialists) was held soon after. No problematic issues were identified; however, it was agreed that some consideration of conducting photo montages and landscaping be started early.

Storelectric has entered into discussions with EDF, the largest supplier of electricity in Great Britain, about another potential CAES site, elsewhere in Cheshire.

In Wilton (Teesside), discussions are ongoing with two major industrials – Sembcorp (utilities, marine and urban development group, total assets of over $22 billion, over 7,000 employees) and SABIC (one of the world’s largest petrochemicals manufacturers, 35,000 employees) – with a view to using their existing salt caverns as CAES locations. As well as the required geology, Wilton is a very good location due to the proximity to the Scottish border (meaning offshore wind coming in via the 400kV interconnector) and offshore wind farms, the largest of which connects to the Wilton site. Wilton also benefits from deemed planning approval, making project development easier.

Other News

Storelectric has been selected as @hellotmrc global finalists for the world-renowned #HTChallenge. From 4,500 applications, Storelectric is one of the 6 finalists in the energy track pitching at the #HTSummit in Paris on March 14-15th. More on the event here -> https://hello-tomorrow.org/summit.

Storelectric is entering competitions and applying for grants on a regular basis. There is a lot of willingness for governments and corporations – such as NAM – to find the next big solution for dealing with the intermittency of renewable energy. As another example, the UK government recently launched the Storage at Scale competition, with a budget of £20 million to be shared by up to 3 demonstration projects; Storelectric is looking to apply.

.

_____________________

Waste to Energy Solutions Ltd

Starting Price: £0.20 per share

Current Price: £0.45 per share

———-

Fundraising for Waste to Energy Solutions remains open.

An introduction to the Waste to Energy sector is available, as is an introduction to gas peakers.

For further information, new 350 PPM investors can register at https://350ppm.co.uk/investments/. Existing clients can contact us.

———-

It’s been a busy start to 2019 for the team at Waste to Energy Solutions Ltd (WES), in particular the exciting news that WES has, via the acquisition of Renewable Energy International, not only acquired all its energy project pipeline, but more importantly bring to the board Phil Allen as a Director and Shareholder.

Phil is well recognised in the waste treatment and renewable energy space and has successfully managed a number of businesses in the organics and waste markets. He has also been involved with the development of renewable energy projects, including waste to energy, AD, biomass, solar and energy storage.

Apart from having a wealth of experience in the industry, Phil has also developed relationships with local authorities, numerous waste management companies, together with some major Chinese corporates and with a number of key enterprises active in this segment (based within the UK and internationally).

This provides Waste to Energy Solutions (WES) with unprecedented access to a number of opportunities in the alternative energy and waste treatment markets. Given the UK Government’s commitment to reducing the impact of waste overall, WES will seek to capitalise on its management’s experience and commercial relationships in these markets.

WES has also secured a significant shareholding in the gas peaker company, Power on Demand Services Ltd (PODS). PODS is working on over 200 MWe of projects through its co-founder and Managing Director Sean Lindgren. Sean has many years’ experience in project management and development in solar and gas peakers, working previously with energy and gas traders to bring projects to the market.

We have outlined below a list of the projects we are currently working on . WES are in talks with several funders from construction finance, equity and debt houses including securing a £50 Million debt facility with a major player in the renewable space for the gas peaker projects.

WES has started working with an UK based data centre group who are looking to build small 20,000 sq. ft. centres with a view of adding renewable/clean/green energy as their power supplier. This opens up opportunities for WES to supply energy plants to the groups existing project plans. This also enables the group to build data centres next to sites WES has in its pipeline, thus making the projects extremely fundable as the power plants can sell the energy for a higher price direct to the data centre.

————

Projects Update

Corby RDF 10 MWe with Planning

WES has had several meetings with a major renewable energy fund, including a site visit and is expecting an offer to buy the project from us which will include a fee and an equity carry. However the company has meetings planned at the end of February with two major EPC contractors who will offer both bankable technology and funding options along with all the required guarantees. All feedstock and off-takers identified.

WES is also looking at the idea of developing a data centre on the land with site visits planned in the coming weeks.

Hull 20 MWe Gas Peaking with Planning

WES has currently two proposals on the table for this project. The first is a buyout option which is expected to go to contract in the coming weeks and an equity/debt proposal, with the debt offer in place with the equity being finalised. The board will make a decision on this once they see the terms of the contract from the buying party, however it is running both options.

Middlesbrough 2.5 MWe AD Plant with Planning

This project is currently being looked at by a funding house in London with a view to providing both the debt and equity portions of the deal. WES is looking at the option of a data centre on the site to enhance the income and the bankability. Also on the site in the coming months, WES is looking to start the planning process for a 10 MWe Gas Peaking plant which will be included in the debt offer proposal.

Kirby 14 MWe RDF Plant

WES is in talks with Stopford Energy & Environment to start the planning process for the site. WES has carried out considerable due-diligence on the site to make sure planning will be achieved. This will enhance the value of the project for WES once planning is given. WES has renegotiated exclusivity on the site which will enable all works to be carried out with a view of attaining a 25 year lease.

WES is also in talks with both funders for the project along with potential buyers.

Stoke on Trent 14 MWe RDF Plant

Stoke will follow Kirby after Stopford develop the planning process with our chosen technology.

Nottingham 10 MWe Gas Peaking with Planning

WES is currently in talks with a major Chinese engineering company (4th largest company in the world in their sector) to build out the project once we have secured an end buyer for the project. Meetings are arranged in the coming weeks with the Chinese and end buyers, however the offer of the debt is already in place.

Nottingham 2 MWe RDF Plant

Alongside the 10 MWe Gas Peaking Plant is a 2 MWe RDF waste to energy project with planning. WES is currently talking to technology providers and once selected will start the funding process with our JV partners on the project.

St. Helens 9 MWe Biomass Plant with Planning

Currently assessing the site for a data centre option, looking at technology and funding.

Along with the projects outlined above, WES is looking at several other projects in the UK covering waste to energy, solar, gas peaking, AD and with the acquisition of REI and Phil’s contact base, the opportunities available to the company can only grow. Working with a variety of projects with various technologies, funders and experienced partners enables WES to grow organically utilising the board and its founders many years’ experience in the renewable sector.

.

_____________________

Contact Information

Tel: +44 (0) 203 151 1 350

Fax: 0203 151 9 350

Level 1, Devonshire House, 1 Mayfair Place, London, W1J 8JA, United Kingdom.

To contact us by email, use the contact us page.

.

_____________________

Risk Warnings

350 PPM Ltd is an Appointed Representative of M J Hudson Advisors Limited (FRN: 692447) which is authorised and regulated by the Financial Conduct Authority in the UK.

Information contained within this post has been supplied by client companies, or taken from sources considered by 350 PPM Ltd to be reliable, but no warranty is given that such information is accurate or complete and it should not be relied upon as such. 350 PPM Ltd will not be responsible for any loss or damage of any kind which arises, directly or indirectly, and is caused by the use of any part of the information provided.

The value of your investments and the income from them can fall as well as rise. An investor may not get back the amount of money invested. Past performance and forecasts are not reliable indicators of future results. Currency denominated investments are subject to fluctuations in exchange rates that could have a positive or adverse effect on the value of, and income from, the investment.

No representation or warranty is given as to the availability of EIS relief / reliefs. Since the requirements to fall within the EIS must be monitored all the time it is possible that if the requirements are met today, they might not be tomorrow. Investors should consult their professional advisers on the possible tax and other consequences of holding such investments.

The investment opportunities associated with this document are only available to persons who would be categorised as professional clients (including elective professional clients), sophisticated investors and high net worth investors as set out in COBS 3.5 of the FCA Handbook:

https://www.handbook.fca.org.uk/handbook/COBS/3/5.html

for professional clients and COBs 4.12.6 R of the FCA Handbook:

https://www.handbook.fca.org.uk/handbook/COBS/4/12.html#DES582

for high net worth and sophisticated investors.

There is no access to the FSCS. Your capital is at risk if you invest. Please see the full Risk Warning here.