Author: Nicholas Dimmock BA MBA(CASS), Head of Corporate Finance 350 PPM Ltd.

_____________________

Q2 2018 Summer Investor Update

_____________________

Headlines

Storelectric: wins €50,000 NAM Challenge & NAM commits to invest €50M in Storelectric’s projects, subject to due diligence.

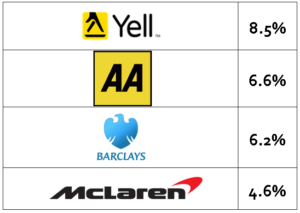

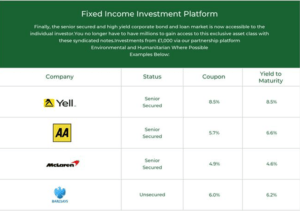

350 PPM: now offer fixed income products / loan notes from household names – examples below with yield to maturities per annum paid to investors.

Solar 350: pitches for $150M venture capital & markets 5 project pipeline (430 MW in total) to solar conglomorates.

Carbon 350: European Union H2020 grant now awarded to Carbon 350. Currently developing the Zero Waste Electronic Market Place. EUA’s increase 27.5% to €16.99, CER’s rally 33% to €0.30, retreating off highs of €0.35.

Disarmco: still awaiting results of $6M bid to United Nations, order book growing with new orders and repeats and most interestingly, work on the Ammunition Disposal Facility (a mobile unit) has started development work.

_____________________

About 350 PPM

350 PPM Ltd is a corporate finance house, providing green investment opportunities (structured under the EIS tax incentive where possible) and assisting “green” companies to raise finance and develop their businesses:

350 PPM Ltd identifies Companies, Projects and Technologies that it believes will benefit substantially from the implementation of The Paris Agreement; the new global treaty to combat climate change and the environmental revolution, which is now fully underway.

350 PPM then structures these opportunities under the UK’s Enterprise Investment Scheme (EIS) if possible and works with, advises and raises finance for the above businesses along the commercialisation runway, to ensure they reach their full potential.

The commercialisation runway is defined within 350 as 4 financing stages: Incubation, Expansion, Venture Capital, and Listing via 350’s NOMAD Partners.

350 PPM always invests in the companies it champions alongside it’s investment clients. By working closely with the company at every stage and assisting in its growth where possible, 350 PPM can protect its and its investor’s interests, influence the outcomes and share in the company’s and its client’s success both now and in the future.

All companies that 350 PPM champions are designed to profit extensively from the implementation of The Paris Agreement. The Paris Agreement is expected to increase environmental investment by circa 1 trillion USD per year above the existing base case each year on average between 2016 and 2050. (Source: International Energy Agency: http://www.iea.org/Textbase/npsum/ETP2012SUM.pdf )

Sir Nicholas Stern, estimates that not combatting climate change will lead to losses in global GDP of between 5 and 20% based on several factors, the most significant of which are breakdowns in supply chains, global unrest through loss of agricultural capabilities, fresh water supply issues, loss of land mass and housing.

Summary and Link to Actual Report can be found here: https://en.wikipedia.org/wiki/Stern_Review.

_____________________

Table of Contents

Executive Summary & Economic Commentary

Social Power Partnerships Ltd (SPP)

_____________________

Executive Summary & Economic Commentary

One of the factors that should be appreciated when appraising opportunities in the environmental sector is the percentage of eventual capacity that the sector is running at now versus expectation of the future rate.

This is effectively the increase of aggregate demand for products, projects and services within the sector. A good proxy for this is the investment in the renewable energy sector, versus what the International Energy Association estimates investment should be per annum to attain The Paris Agreement objectives.

Renewable Energy is perhaps the most advanced of the main subsectors. The others being: Carbon Abatement, Energy Efficiency and Mitigation and Adaptation.

REN21 provides an excellent yearly update which you can find here: http://www.ren21.net/gsr-2018/. According to REN21, Renewable Energy Investment is currently running at $279.8 Billion per year.

However, The International Energy Association estimates it needs to increase 5-fold:

The IEA estimates to achieve the objectives of the Paris agreement, global investment in renewables needs to increase by $36 trillion above the base case scenario between 2016 and 2050. Based on an immediate increase in green investments, breakeven should be achieved by 2025, and by 2050, $100 Trillion will have been saved in fossil fuel input costs.

Source: http://www.iea.org/Textbase/npsum/ETP2012SUM.pdf.

Consequently, aggregate demand for renewable energy products, projects and services is running at about 1/6 or 16.6% of what it will do the in future.

The simple maths is that according to the IEA, investment in renewables needs to increase from $279.8 billion to $1.338 Trillion (36 trillion / 34 (years between 2016 and 2050 + $279 Billion)) per year and that amount needs to be maintained each and every year to 2050. Obviously, this is not going to happen overnight. However, the rate at which this investment climbs to what it needs to be will be heavily dependent on 2 factors:

- The costs of renewables which are falling and are relatively predictable.

- The additional subsidization mechanisms introduced by Article 6 of The Paris Agreement, which are due to be agreed in COP 25 at Katowice in Poland in November.

Hopefully, the subsidies will be such that the environmental revolution accelerates like a scolded cat. This will hopefully be the case as climate change is accelerating and if we don’t do something about it, the world is going to be in all sorts of difficulties.

However, my point is that, currently the renewables sector is running at 16% of anticipated aggregate demand. The other subsectors are well behind this.

This is the reason that companies that we are operating, championing and promoting are requesting investment. This then helps them scale their operations in advance of increases in aggregate demand for their projects, products and services and hopefully will enable them to become the trailblazers of tomorrow if they are not yet the trailblazers of today.

I only say this because I see a lot of companies being financed utilising existing investment themes, with little hope for increases in aggregate demand, where I cannot see where and when an exit would ever be possible.

I will just provide an excerpt from Chapter 3 of REN21’s Global Status Report which details Solar Power and is of course relevant to Solar 350 Ltd, details of which you can find later in this report:

“The year 2017 was a landmark one for solar photovoltaics (PV): the world added more capacity from solar PV than from any other type of power generating technology. More solar PV was installed than the net capacity additions of fossil fuels and nuclear power combined. In 2017, solar PV was the top source of new power capacity in several major markets, including China, India, Japan and the United States. Globally, at least 98 GW of solar PV capacity was installed (on- and off-grid), increasing total capacity by nearly one-third, for a cumulative total of approximately 402 GW. On average, the equivalent of more than 40,000 solar panels was installed each hour of the year.” http://www.ren21.net/gsr-2018/chapters/chapter_03/chapter_03/#sub_5.

———-

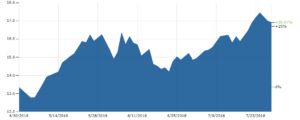

The State of Environmental Markets Today

Now a proxy for the health of the environmental revolution, European Union Allowances (EUA’s), the European Bellwether of Europe’s climate change effort, continue to gain, so this is €4 to €17 in 15 months, with the chart below displaying the last 3 months.

Chart of European Union Allowance (EUA’s):

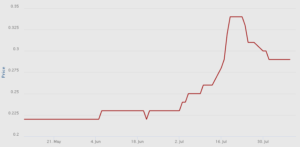

Certified Emissions Reductions, which could be construed as an International Bellwether of international policy developments, have increased from 20 cents to a high of 35 and back to 28 as of 30/7/2018. Chart of Dec 18 CER futures:

So, things are certainly moving the right direction from a capitalist environmental point of view.

———-

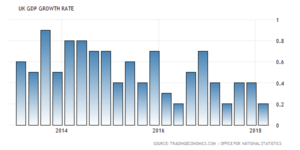

The United Kingdom

I am afraid it is not good news: The UK Economy grew 0.2% in Quarter 1 – Jan to Mar 2018 – revised up from 0.1%.

Here are the last 4 years quarterly:

A mid cycle slowdown is fine and expected at this stage of the economic cycle, but this could be the Brexit effect: 0.2% increase in GDP is not good for Q1 2018.

———-

And Finally (these are our own opinions and in no way should be construed as Investment Advice)

We are rather cautious of the high yielding “renewable energy” bonds being offered and advertised via Google at present.

In our investigations into offering debt products, we have found that these pay 20% commission to the brokers selling them and offer up to a 12% yearly interest payment or coupon mostly paid biannually. While this is attractive to potential brokers (like 350 PPM), we consider it a red flag.

Renewable Energy Bonds should be paid from cash-flows from renewable energy assets and secured against the asset. Lending to an Operational Wind Turbine should pay around 4-5% yield as cash-flow is from electricity contracts and wind is relatively stable and predictable over a yearly period. You might consider these risks lower, under certain situations than lending to a corporate. Banks are generally falling over themselves to lend to these installations / project companies, so I cannot see why these installations / project companies are looking to attract private investors and pay such a hefty coupon.

We suspect the funds raised are being used for construction, which brings forth a whole new set of risks. Collectively, to pay the broker commissions, and the investor the coupon, while making sure the principal is back up to 100% ready for redemption in year 5, I estimate costs to issuer would be circa 18% which consists of 12% a year to the investor and 6% a year to build the principal back up to par (before other admin charges). This is exceptionally high in a low interest environment.

As such, this is not really adding up. An additional red flag is that many of the firms offering the same products are not regulated. There have been some notable defaults of late, which just means investors should do their due diligence before investing (in our opinion).

https://www.telegraph.co.uk/investing/bonds/regulator-cracks-mini-bond-firm/

https://www.ft.com/content/9b3b9ade-7edd-11e8-8e67-1e1a0846c475

Obviously as soon as we have suitable Green / Renewable Energy Bonds, we will be adding these to our fixed income platform, but for now, we just have the major corps.

_____________________

Climate Changes News and Links

Climate change: ‘Hothouse Earth’ risks even if CO2 emissions slashed:

https://www.bbc.co.uk/news/science-environment-45084144#

Earth at risk of entering ‘hothouse’ state from which there is no return, scientists warn:

Climate Change News: http://www.climatechangenews.com/

Environmental Finance: https://www.environmental-finance.com/

Business Green: https://www.businessgreen.com/

London Stock Exchange, Green Business: https://www.lseg.com/resources/2013-14/1000-companies-inspire-britain/green-business

World Bank Climate Finance News: http://www.worldbank.org/en/topic/climatefinance/news

Climate Change News from UNFCCC: https://unfccc.int/

Climate Change and Vital Signs of The Planet from NASA: https://climate.nasa.gov/

Climate Central: http://www.climatecentral.org/

Climate Central: http://www.climatecentral.org/news/world-passes-400-ppm-threshold-permanently-20738

Clean Energy Pipeline: http://www.cleanenergypipeline.com/

Megawatt – X : https://www.megawatt-x.com/

Green Deal Flow: https://greendealflow.com/

350 PPM on Twitter: https://twitter.com/350ppmltd?lang=en-gb

Nick Dimmock Tweets: https://twitter.com/NickD350

Now onto the company reports.

Carbon 350 Ltd

Starting Price: £13.50 per share in 2008

Current Price: £587.47 Per Share Based on ZWIM Forecasts Submitted to EU and Certified Emission Reduction Pipeline.

Please note: Carbon 350 was never financed by 350 PPM Ltd as its formation was previous to 350 PPM’s existence.

———-

Carbon 350 has been involved in accreditation, development and brokerage of emission reductions from circa 40 environmental projects leading to certified emission reductions of circa 126,000,000 over the crediting period of the projects.

A European Union H2020 Grant has now been awarded to Carbon 350 Ltd, and after a lot of too’ing and fro’ing with the EU we have received the first installment. We are currently developing the Zero Waste Electronic Market Place.

EUA’s (European Union Allowances) increased 27.5% to €16.99, CER’s (Certified Emission Reductions) increased 75% to €0.35, retreating off highs of €0.28, in the last three months to July 30th.

Accordingly, it would appear that both emissions trading schemes and the potential offsetting mechanisms as detailed in Article 6 of The Paris Agreement are back on track. This is certainly what we are hearing via various UN meetings and delegates.

Solar 350 Ltd

Starting Price: £2.50 per share

Current Price: £30 per share

———-

Solar 350 signed an agreement to develop two projects for PAPA ONE LTD (Paris Agreement Project Accelerator). While we received the first payment of £42,000, for reasons unrelated to Solar 350, and our projects, PAPA ONE’s investor is now not in a position to proceed.

Rumour has it that they have experienced a very significant loss in another investment sector. There is really not much we can do about it with the exception of taking legal action against PAPA ONE and them in turn taking legal action against their investors. This is not something that we are going to pursue, and we feel its much better to preserve the relationship as their reasons are genuine.

Finding Another Way

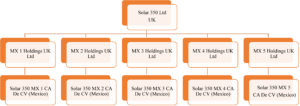

Accordingly, we discounted this avenue in April and began marketing our 5-project pipeline to Venture Capitalists, solar developers, solar conglomerates and banks, under the structure detailed below.

Please note that not all Project Companies currently conform to this structure and some of the projects are independently owned and under different names. Regardless, this is an attractive pipeline for banks, developers and VCs, due to the continuity: the first project is shovel ready / ready to build, the 2nd project is 12-15 months away from this point, the 3rd is a little bit further off etc etc, which means that once the cycle is running, there is continuity.

This is important, due to the long lead time in preparing sites for construction; prospecting, negotiation, exploration, feasibility studies all occur before you can really get on with the development work.

New Parties

We are now identifying the parties we will work with for the construction stage and intend to replicate these relationships in future projects. This involves finding equity, debt and an EPC to build it. We envisage financial closing on the first project by December 2018.

Currently, we have around 6 banks we are speaking to with a view to arranging debt of circa 70% of project CAPEX and around 12 equity providers (that in some cases will also provide EPC and Panels) for the remaining 30%.

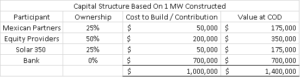

We anticipate that the equity will cost us around 50% of the project. Rather like Property Development, there is a circa 40% uplift between the cost of construction and Commercial Operation.

Structure

Accordingly, the capital structure before construction and after construction along with valuation should look something like this. COD is Commercial Operation Date; i.e. the project is generating power.

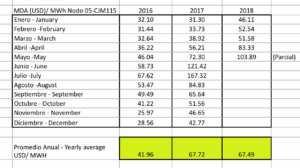

Due to various reasons, one of which is the uncertainty that accompanies market liberalisations (the Mexican Power Market has only recently been liberalised), we are using Merchant Power Purchase Agreements (PPA). With these agreements, there is no fixed price of electricity and the project simply receives the price of electricity calculated at the specific node based on demand and supply.

Electricity Prices

For those of you that would like an independent review of what is happening in Mexico and LATAM, please click on the following link or simply Google Search: Mexico Solar, LATAM Solar or similar.

Mexico’s Solar Market Is Booming, but Still Has Key Hurdles to Clear.

Greentech Media: https://www.greentechmedia.com/articles/read/mexicos-solar-market-is-booming-hurdles-clear

The future looks bright for solar energy development in Mexico – pv …

PV Magazine: https://www.pv-magazine.com/2018/02/19/future-looks-bright-for-solar-energy-development-in-mexico/

Will Mexico Be the Next Solar Super Power? | Morgan Stanley

https://www.morganstanley.com/ideas/mexico-decarbonization-solar-power

Electricity prices also confirm this and are rising quickly as detailed below at the Node where project one is due to export its power to. This can be seen in the increases in power prices across 2016, 2017 and 2018.

As an update, May 2018 figure was 131 USD/MWh, June 159 , July 177. Accordingly, we expect an average figure of circa 100 USD/MWh for last 12 months to end February 2019.

The merchant PPA has been well received by a few banks and we are now close to receiving a term sheet / proposal, which is the offer of the debt finance. We expect this to come in at around 200 basis points over base rates.

Cost of Capital

As base rates are circa 8% in Mexico, this means a cost of capital of around 10-11%. As such, our medium-term strategy, once the project is built and has been running for a while, would be to swap the Merchant PPA with a fixed price PPA with an Industrial company in Mexico with the PPA denominated in USD (most of them are exporters so this isn’t an issue) and then refinance the projects in USD.

This drops the cost of capital down from circa 10-11% to circa 3-4% and thus boosts the value of the project further and thus the onward sale price.

Moving Forward

However, what is most important, is that a structure and consortium is forming which will allow to development of a pipeline of projects under the same or similar terms. This means volume development, which was the way we achieved such success back in the days of the Kyoto Protocol. Only this time, rather than a variety of projects in China, our focus is Solar in LATAM.

With LATAM receiving circa 2,000 – 2500 KWh of energy per metre squared annually, versus Glasgow at circa 500 and Bournemouth at 1100 and with rapid economic development as economies transition from developing to developed and with proven and stable legal systems, Solar 350 is sensibly positioned to profit from the environmental revolution that the Paris Agreement brings forth.

____________

350 PPM LTD

Starting Price: £12.50 per share

Current Price: £130 per share

———-

350 PPM’s will shortly be filing its Accounts to November 2017. They are expected to show profits during this period of circa £130,000.

These profits are solely from equity success fees we have taken in lieu of cash commissions as per our model of investing 40% of our fees in the companies we promote to investors. As such, evidently, we survive on the cash fees and profit from the equity fees. Both Solar 350 and Storelectric have shown significant gains during the year and accordingly, these increases will be reflected on our balance sheet.

Restructuring

While these results are very impressive in our first year of trading, over the last 6 months we have chosen to restructure the company into what we anticipate is a “modern firm”. This has involved closing our 2 Regus offices and operating a more decentralised and electronic platform structure, as well as partnering with 3rd party entities with the distribution we require.

As such, we can now be considered a hybrid, hopefully combining the best of both worlds: personal interaction (someone to discuss investment themes and opportunities with) and electronic platforms (the ability to transact online and the volume capabilities this provides).

This semi-downtime has also provided the opportunity to deal with some of the issues we encountered in the first year of trading and find solutions to some of the issues that have restricted growth.

The three main issues we have had are as follows:

- The inability to attract the volume of new clients to our business and sector that we wish.

- This is understandable as the environmental sector is only now recovering.

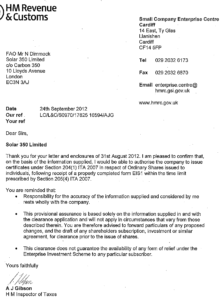

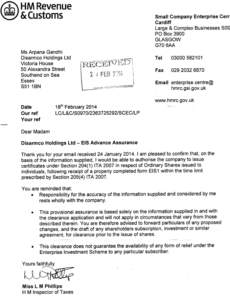

- The inability to speedily gain EIS3 certificates for our clients that wish to claim Tax Reliefs when available.

- HMRC and Small Companies Enterprise Centre are very sensitive to environmentally themed businesses and getting them familiar with how we operate has taken some time

- The inability to offer any other worthwhile complimentary investment products to our potentially high yielding equity offerings.

- There is no reason to restrict our offerings to equities, just as long as we have to necessary understanding of alternative products and the risk/reward profiles do not compete with each other.

We believe we have solved all three of these issues and are effectively relaunching the business from the 14th of August. Our investor relations personnel will be in touch to update you as we prepare for this year’s slate of equity and debt offerings.

Syndicated Bond Investments from Major Brands

We have launched a new Debt Investments / Syndicated Bond Platform. Access today via our new investments page. Some of the offers can be seen below:

I do find some of these rather amusing; Barclays for instance; you can keep your £200,000 in a Barclays Bank Account and they will pay you circa 0.25% per annum and lend your money out themselves.

Or you can withdraw your funds from Barclays and effectively lend them your money gaining a 6% coupon or a 6.2% Yield to Maturity on the syndicated bond we will be offering.

Of course, there is more risk in the bond, as the government is not guaranteeing circa 80k of your deposit, but there is still a striking difference between Barclays looking after your money and lending it our or alternatively, you lending your money directly to Barclays.

So, in summary, its 0.25% interest in a bank account and 6.2% Yield to Maturity if you take your funds out and lend it back to Barclays!

Two more things about these Syndicated Bonds:

- There is a 0.25% charge for early redemption and liquidity is not guaranteed

- There is also a managed account that spreads your investment across all the syndicated bonds in the range and thus you get a composite yield of around 4.25%. (we can get you 5%, but this would be for 400K and above), but this clearly diversifies your holdings and thus reduces risks for a similar return – “the efficient frontier”.

Alternatively, you can pick and chose yourself. Personally, if it were me, I would probably stay away from the “high street”.

Good Trading Ahead PPM’ers

We are looking for more clients so please do tell your friends, associates and help publicise the fight against climate change and the potential of the sector.

Simply direct them to our website: www.350ppm.co.uk or our landing pages at and ask them to register www.350ppm.co.uk/investments or www.350ppm.co.uk/investment

or send us a message and we will do the rest. These new pages are going up now.

The consensus is that this will be a 2-3 trillion USD environmental revolution and we believe we are looking at the creation of 100,000 environmental projects between now and 2050.

I fully expect 350 PPM and our corporate clients to be at the centre of it.

Enterprise Investment Scheme

Just in finishing, we have posted the EIS Advanced Assurance Letters from HMRC for every company we promoted last year to give you some confidence that your reliefs are on their way. Solar 350 has had an issue which has been rumbling on 2 years, but we are in the final step of resolving that.

The other two don’t have any issues to the best of our knowledge and it simply seems that Small Company Enterprise Centre cannot cope.

350 PPM’s own EIS offer will cease for 2018 on the 14th August when we start raising for this year’s slate.

Disarmco Holdings Ltd

Starting Price: £5.51 per share

———-

Report Confidential but Available to DISCO Investors upon request.

Please contact your 350 PPM Investor Relations Consultant or NathanR@350ppm.co.uk for your copy.

Storelectric Ltd

Starting Price: £24.85 per share under EIS

Current Price: £150 (according to Storelectric)

———-

Storelectric wins international competition and contract for ‘game-changer’ large-scale storage of renewable energy

Ahead of 44 other companies from 13 countries, Storelectric is the winner of this year’s 70th NAM Challenge, a prestigious international energy competition run by NAM, Holland’s largest energy company jointly owned by Shell and Exxon. Storelectric’ s solution for the large-scale storage of renewable energy uses current infrastructure and wins €50,000 together with its implementation with NAM across the Netherlands.

The jury believes; that (with Storelectric’ s competencies) “energy transition in the Netherlands will take a big step forward. Large-scale energy storage is a crucial factor for accelerating energy transition in our country.”

Photo: Storelectric Director; Tallat Azad, Managing Director of Storelectric Ltd. presenting before the judges and audience of over 70 at the 70thNAM Challenge in Utrecht, Holland.

Photo: The NAM70 Challenge cheque is presented to Storelectric Ltd. Left to Right: Gerald Schotman, CEO NAM and President KIVI with Storelectric Ltd.’s Mark Howitt, CTO, and co-founder, Tallat Azad, Managing Director and Jeff Draper, CFO and co-founder.

The Winning Innovation

Storelectric’ s technology is Compressed Air Energy Storage which enables a surplus of wind or solar power to be stored efficiently over long periods. Energy storage for times of peak demand, in the evening and Winter, has been one of the major challenges for the renewable energy sector. Storelectric’ s solution is to use surplus energy to compress and store air in salt caverns; effectively, underground reservoirs. When the energy is needed the air is released. The air pressure difference generates usable energy when needed.

Storage of renewable energy is becoming crucial to maintaining the stability of the future energy system and balancing supply and demand throughout the seasons. The period of frosty weather, last winter, showed how important underground gas storage was for NAM in meeting the increased demand for energy and how important it is to develop a sustainable equivalent for renewables as quickly as possible.

The NAM70 Challenge

The NAM70 Challenge from Holland’s biggest energy company, is an initiative for companies with new technologies to work on the large-scale storage of sustainable energy, to make their solutions workable in practice and scale them up to the required level. As part of the judging process Storelectric visited existing plants in Germany and Holland and spoke with NAM’s technical specialists.

The jury assessed solutions for innovation, applicability, social importance and scalability. Storelectric was shortlisted to present ‘Enabling Renewables to Power the Grid’ to the jury and the Dutch CEO’s of Shell and Exxon in a ‘Dragon’s Den’ style event in Utrecht along with Proton Ventures from The Netherlands and Eco-Tech Ceram from France and was a unanimous winner.

The Verdict

The jury commented: “Our decision is based on the possibilities the solution offers for large scale storage of renewable energy. Furthermore, the solution offers the possibility to be implemented on existing NAM locations. We view Storelectric’ s solution as a game-changer that has the potential to speed up the energy transition.”

Gerald Schotman, NAM Managing Director added; “Given the challenges and ambitions that the Netherlands faces with the current energy transition, I am delighted that we have taken a concrete step towards accelerating it today. No company or organisation, including NAM, can solve this on its own. Combining knowledge, expertise and innovation helps us to move forward as a country. We are looking forward to further collaboration with Storelectric to shape this solution over the coming months.”

Tallat Azad, Managing Director of Storelectric Ltd. said: “Winning The NAM70 Challenge is a fantastic boost for Storelectric and its proven technology. The opportunity to re-purpose oil and gas infrastructure for renewable energy storage is a potential game-changer for the transition from fossil fuels to a full baseload renewable energy system and shows the Netherlands, with NAM, has the potential to be World-leading in the renewables race.”

He added; “As well as the €50,000 prize, the commitment Storelectric and NAM have is to build large scale underground renewable energy storage in Holland and potentially the North Sea, to back up and store the massive amounts of intermittent energy that will be coming from large scale offshore wind farms and onshore solar over the next decades.”

———-

Storelectric CAES Project Critical for EU Infrastructure

Named in top 100 EU energy projects. Approved as EU Project of Common Interest (PCI)

Storelectric is now among the 106 most important electricity infrastructure projects in Europe, among which we are one of only 15 Storage PCI projects with the majority of these being pumped hydro. Ours is the only viable CAES project giving Storelectric a unique position in Europe.

Storelectric’ s first project has been accepted both as a European Project of Common Interest and on the Ten Year Network Development Plan (TYNDP) of the European Network Transmission Service Operators – Electricity (ENTSO-E) organisation set up by the European Commission. This means that Storelectric are officially recognised as important infrastructure at a continental scale. The accepted project is CARES (Compressed Air Renewable Energy Storage), item 1.12.3 on the “third PCI list“, see page 5, accessible through their website.

Storelectric is applying for funding from the €26bn Connecting Europe Facility, which helps gain access to other EU funding, and provides access to a single point of contact with a maximum 3.5-year period for all permits in any member state. Up to 75% funding is available with the current application for the 540MW CARES project due in by October 10th, 2018. This call will be decided before Brexit and as such will be guaranteed by the UK government.

Projects of Common Interest are managed by the European Commission under TEN-E regulations.

To read more, please click here.

———-

NAM70 Post Victory Visit

Following a workshop on July 9th at the NAM HQ (attended by the Directors of Storelectric and their Chairman and a 10-member strong team from NAM) in Assen an agreement in principle was reached describing how NAM and Storelectric will jointly develop CAES projects, we hope to share some very exciting news on this front in our next update.

World Energy Forum 2018

Storelectric have been personally invited by the President of WEF to present their CAES “Advance Storage Technology” at the WEF2018 conference to be held in China between 10th-12th August 2018, this will include a panel session at which our Managing Director Tallat Azad will take part.

Just in closing the Storelectric section, and subsequent to Storelectric’ s victory visit to NAM in Netherlands, NAM have now confirmed and committed verbally (subject to final DD) that they will invest a minimum of €50 Million in Storelectric’ s Projects. We will have this in writing ready for Storelectric’ s next funding round in September.

Social Power Partnerships Ltd (SPP)

Starting Price: Coverage Initiated

Current Price: Model not yet validated

———

I have personally invested £10,000 in this business and we are monitoring their progress.

LongBay SeaPower

Starting Price: Coverage Not Initiated

Current Price: Coverage Not Initiated

———-

We are currently in contract negotiations with this company with a view to offering it later in the year. Issue is currently that we cannot secure enough stock in the company ourselves.

The company is now completing a full and in depth feasibility study on the project, so most likely this raise will be pushed into 2019.

_____________________

Tim Hyett

Regrettably, after a long period of ill health, Tim Hyett Managing Director of 350 PPM Ltd and Fellow of the Chartered Institute for Securities and Investment, died in July 2018.

Tim started his stock broking career in 1980 on the floor of the London Stock Exchange with Scrimgeour Kemp Gee. From here he moved to Morgan Grenfell, then Pru Bache, where he was made a Member of the London Stock Exchange in 1985 at 23 years old. Then to the “Buy Side” with Newton Investment Management and was then poached by Foreign and Colonial where he was Director of UK and International Equity trading for eight years. In 2004, Tim co-founded Markham Hyett Delaney Ltd, who were an Appointed Representative of Pritchard Stockbrokers. Tim is a Member of the Chartered Institute for Securities and Investment (CISI).

Tim joined 350 PPM in November 2015, and was instrumental is assisting us with gaining our Appointed Representative Status, initially under Kession Capital Ltd and subsequently under M J Hudson Advisors Ltd. He leaves behind 3 sons.

_____________________

Contact Information

Tel: +44 (0) 207 268 4873 (Switch Board)

Tel: 0203 151 1 350 / 0203 151 2 350 (Direct)

Fax: 0203 151 9 350

Level 1, Devonshire House, 1 Mayfair Place, London, W1J 8JA, United Kingdom.

_____________________

Risk Warnings

350 PPM Ltd is an Appointed Representative of M J Hudson Advisors Limited (FRN: 692447) which is authorised and regulated by the Financial Conduct Authority in the UK.

The value of your investments and the income from them can fall as well as rise. An investor may not get back the amount of money invested. Past performance and forecasts are not reliable indicators of future results. Currency denominated investments are subject to fluctuations in exchange rates that could have a positive or adverse effect on the value of, and income from, the investment. No representation or warranty is given as to the availability of EIS relief / reliefs. Since the requirements to fall within the EIS must be monitored all the time it is possible that if the requirements are met today, they might not be tomorrow. Investors should consult their professional advisers on the possible tax and other consequences of holding such investments.

The investment opportunities in this website are only available to persons who would be categorised as “professional clients” (including “elective professional clients”) as set out in COBS 3.5 of the

FCA Handbook: www.handbook.fca.org.uk/handbook/COBS/3/5.html. There is no access to the FSCS. Your capital is at risk if you invest. Please see the full Risk Warning here.

1 thought on “Summer Investor Update: Q2 2018”

Comments are closed.